Market wrap: Electricity futures prices trended up during the month of August due to a combination of factors including uncertainty in the political sphere, the dumping of the National Energy Guarantee, electricity infrastructure failures and prolonged drought.

Locking in energy contracts on the wholesale market is a solid way to futureproof your business against electricity shocks by locking in prices for one, two or three years in advance.

In doing so, you will have security in terms of knowing exactly what you will be paying in advance, allowing for budgeting, forecasting and financial planning.

Political uncertainty

The market up until recently had been anticipating the introduction of the National Energy Guarantee. The shelving of this policy and subsequent uncertainty around what will replace it has added a risk premium to rates.

Weather & drought

Australia continues to be held in the grip of a prolonged drought, which has affected generation capacity from hydro sources.

Low levels of water in the dams mean that there will be less hydro generation available over the crucial Summer peak period, especially at the Snowy hydro facility in New South Wales. Water levels in Lake Eucumbeneare currently only around 16%.

Although there is snow cover on the mountains, conditions are dry, resulting in less water runoff into storage dams.

Other drought factors that are coming into play include the increased demand by farms which are drawing on electricity supply to mitigate the adverse effects that the drought is having on their farms and livestock. When the Sydney Desalination plant ramps up in December this will add 38MW to NSW demand.

Maximum demand for August was lower than July in all states, with average demand down by up to 300MW.

Queensland was an average of 1.5 degrees cooler than the previous year, with heating driving average demand higher than 2017 by 100 MW. South Australia was warmer than last month and August 2017, with its average demand lower by more than 100 MW, due to less demand for heating.

Generation & intercnnector faults

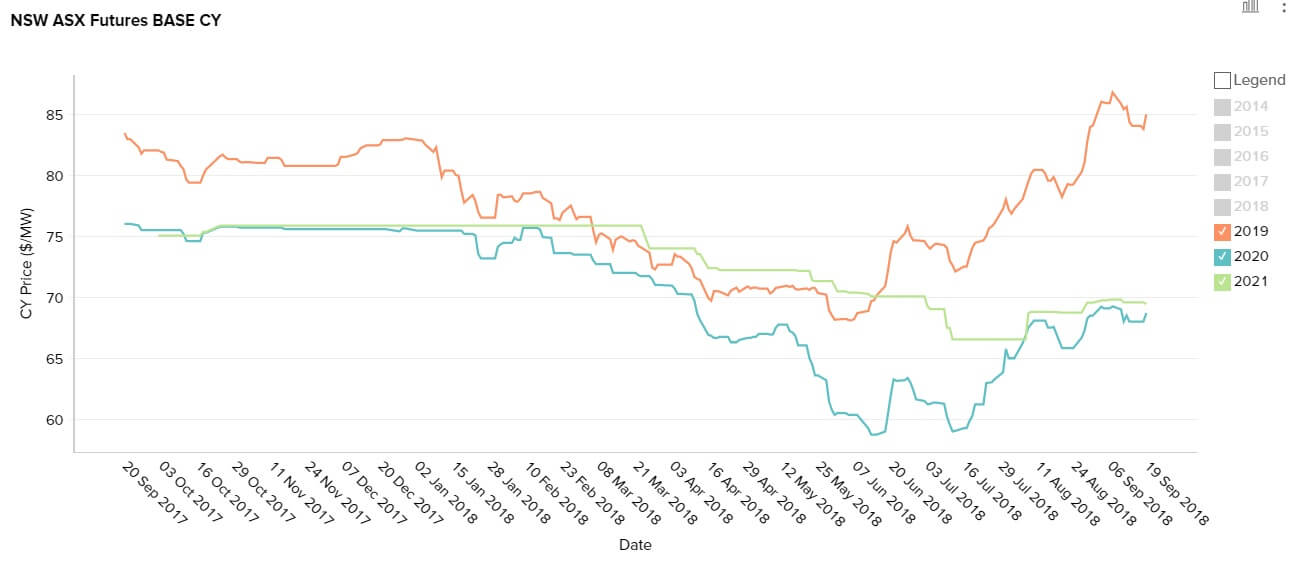

New South Wales

New South Wales lost over 3000 MW of capacity throughout August due to five large coal plants tripping and going offline. In addition to the faults, other thermal generators were producing energy at reduced capacity due to partial system failure.

This led to electricity prices in New South Wales being higher on the National Energy Market.

As a result of the failures, interconnector supply flowed into New South Wales to make up for the shortfall, and prices hovered around 45c/kWh on the spot market.

Peak Futures price (September):

2019: 8.5c per kWh

2020: 6.87c per kWh

2021: 6.94c per kWh

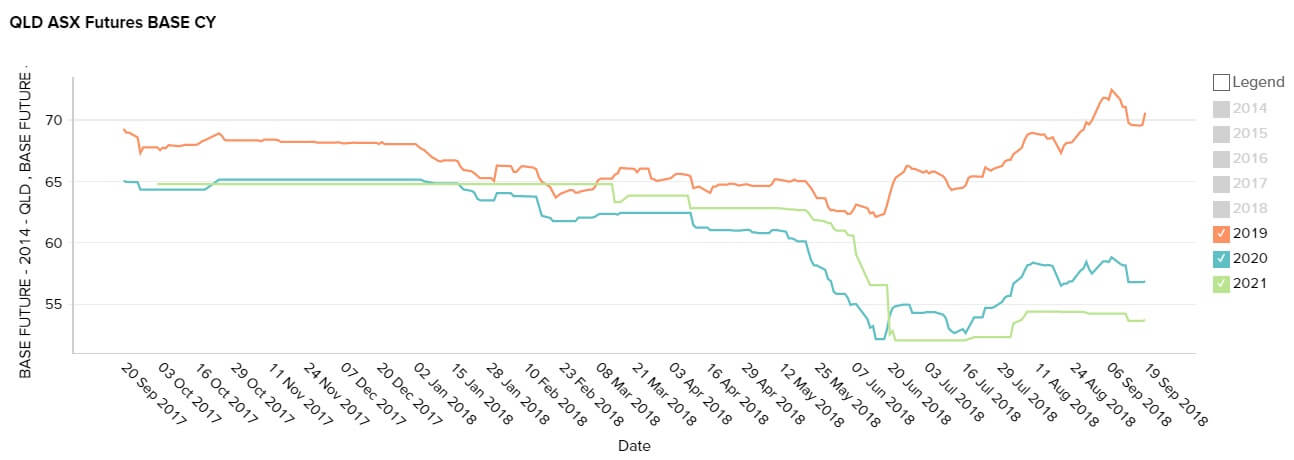

Queensland

Queensland also suffered generation losses at three large thermal plants for most of August, but this was offset by gas-fired generation and solar.

Peak Futures price (September):

2019: 7c per kWh

2020: 5.7c per kWh

2021: 5.4c per kWh

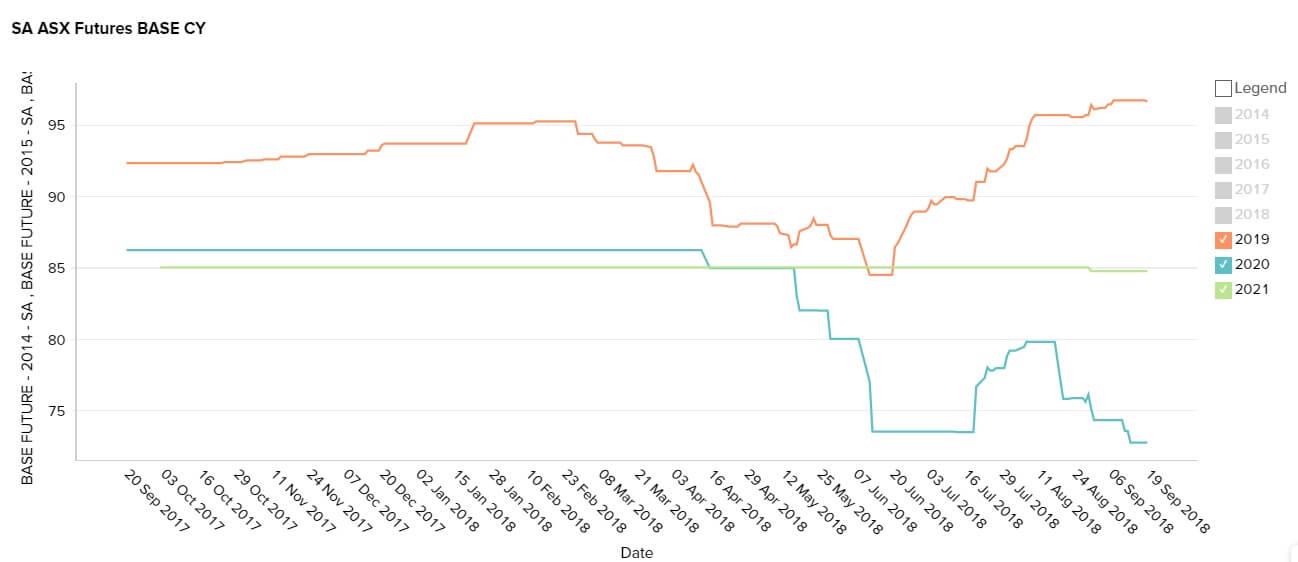

South Australia

South Australia’s wind generation was higher than the previous month and 25 percent up on the previous years, which placed downward pressure on prices. However, wind generation in the southern state can drop off at times, leading to shortfalls.

Peak Futures price (September):

2019: 9.7c per kWh

2020: 7.3c per kWh

2021: 8.5c per kWh

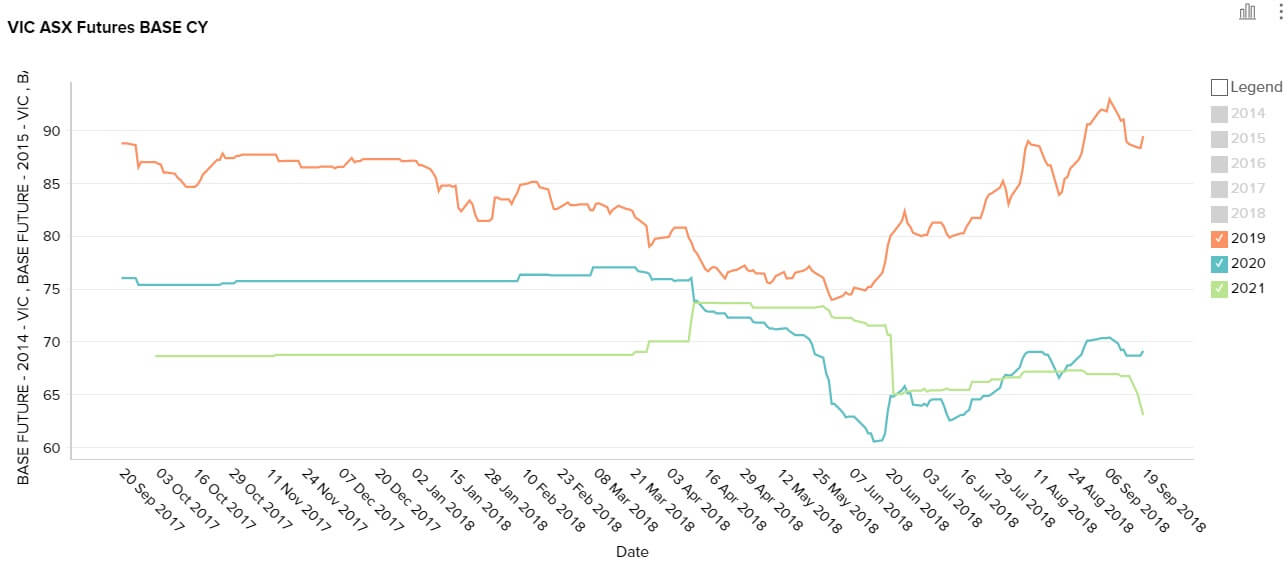

Victoria

Victoria also experienced higher wind generation than usual, both in terms of monthly and year-on-year figures, largely due to new wind farms that have come on stream.

Peak Futures price (September):

2019: 8.9c per kWh

2020: 6.9c per kWh

2021: 6.3c per kWh

Interconnector Tripping

The New South Wales – Queensland Interconnector tripped due to a lightning strike while the former state was importing 850MW to make up for the shortfall resulting from power-plant failures. This resulted in load shedding across all states apart from South Australia.