Happy New Year and welcome to our December 2025 electricity market update.

December delivered a notable easing in electricity prices across the NEM, providing a positive start to the year for energy users. Spot prices finished well below December 2024 levels across all regions, despite generally warm summer conditions. This outcome reflects strong generation availability and improving system flexibility, underpinned by higher renewable penetration, increased battery discharging, and elevated levels of renewable curtailment—particularly during daylight hours.

These spot market outcomes were mirrored in the futures market, where prices softened through December across most regions and along the forward curve. The movement suggests the market continues to unwind summer risk premiums that have persisted since the 2022 energy crisis, with forward prices increasingly reflecting confidence in supply adequacy rather than defensive pricing for peak demand conditions.

The sections below first summarise national market outcomes before stepping through state-by-state spot prices, futures movements and generation mix changes, highlighting the key dynamics shaping electricity markets as we move into the new year.

National Electricity Update

Spot Prices

December delivered another month of low spot prices across the National Electricity Market (NEM), causing electricity futures decline significantly as the NEM gains confidence in handling hot summer months.

| Region | Dec-24 ($/MWh) | Dec-25 ($/MWh) | % Movement |

|---|---|---|---|

| NSW | 134.73 | 71.36 | -47.0% |

| QLD | 134.44 | 54.38 | -59.6% |

| SA | 61.47 | 27.92 | -54.6% |

| TAS | 76.11 | 59.34 | -22.0% |

| VIC | 52.25 | 27.51 | -47.3% |

| NEM AVERAGE | 91.80 | 48.10 | -47.6% |

December spot prices finished materially lower year-on-year despite warmer-than-average conditions across much of the NEM, highlighting ample generation availability across the grid. While overall supply volumes were relatively similar to December 2024, the generation mix and system behaviour shifted:

- Renewable generation share increased by ~5%, rising from 44.9% to 49.7%

- Battery discharging materially increased, from 67 GWh in Dec-24 to 248 GWh in Dec-25

- Renewables curtailment rose from 718 GWh to 1,203 GWh, indicating surplus generation, particularly during daylight hours.

Together, these factors suggest the market was well supplied despite hot weather, reinforcing confidence in the NEM’s ability to manage sustained periods of elevated demand across multiple states, causing the futures prices to decline throughout the month of December.

Futures Prices

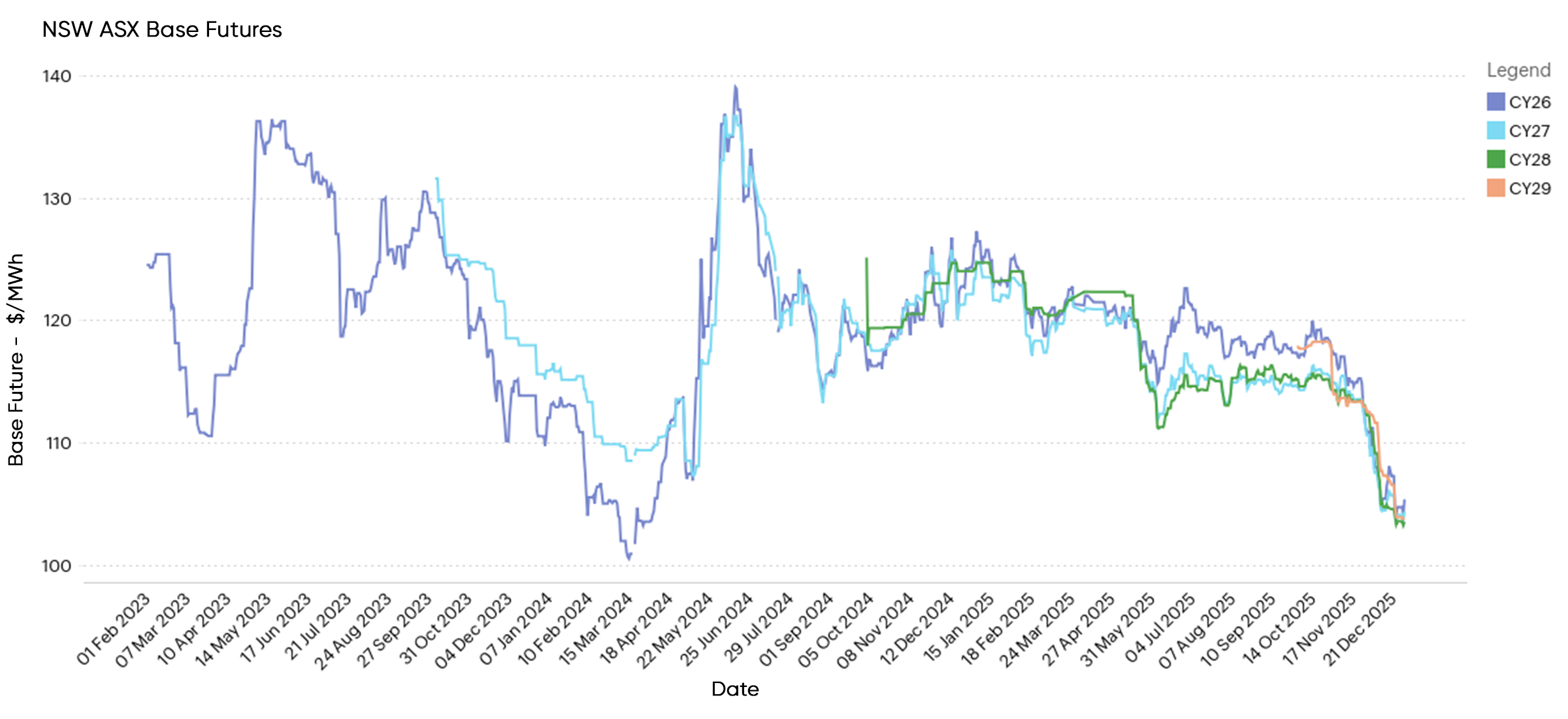

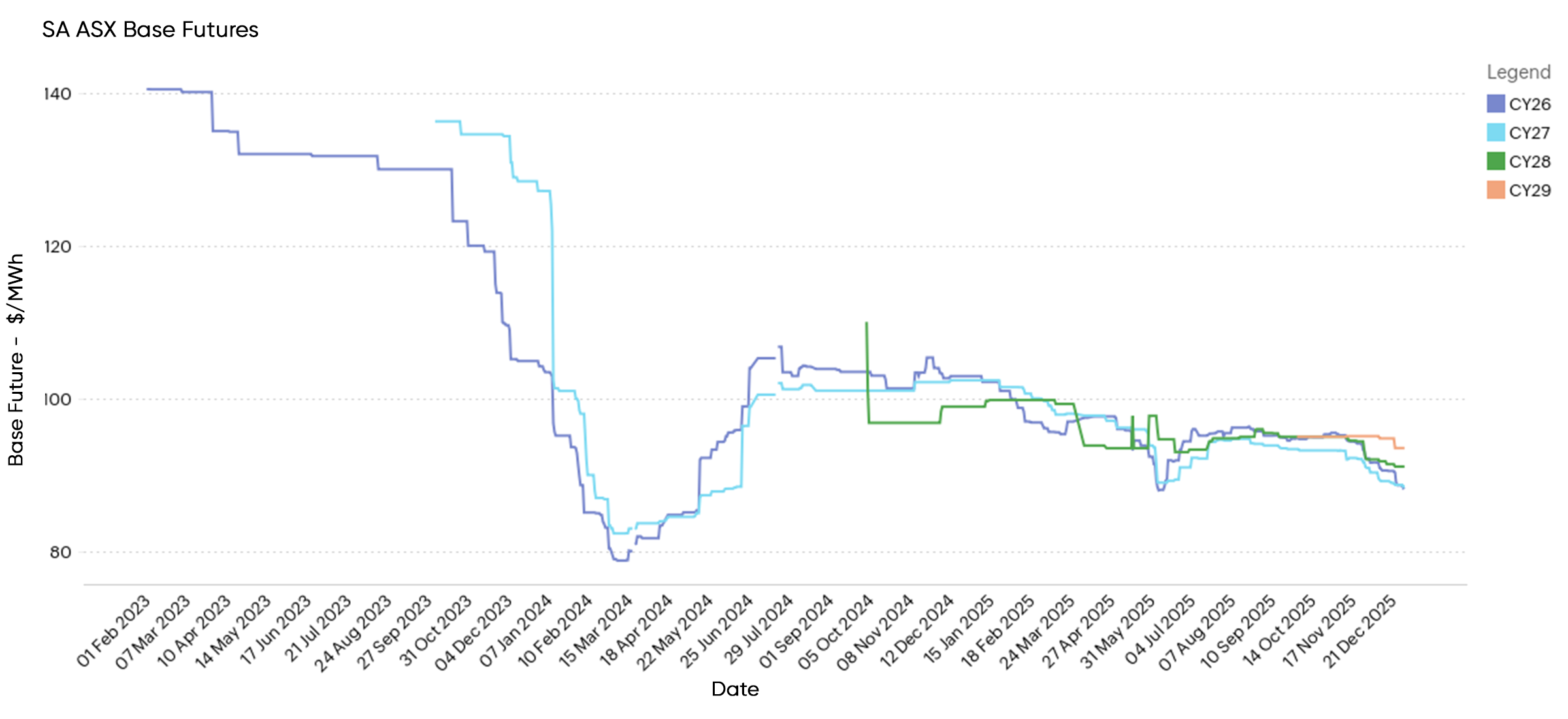

With spot prices declining through December, the futures market has responded by following a similar downward trend. After the volatility & high prices of the 2022 energy crisis, prices stabilised around early 2023 and have since traded within a relatively consistent range.

Looking at average futures prices across the states since January 2023, the national average at the close of December 2025 is now trading at around $90.5/MWh, approximately 8% below the post-2023 average. This repositioning suggests the futures market has responded to weaker spot outcomes by further unwinding residual summer risk premiums, reinforcing confidence in underlying supply conditions.

This presents an attractive window for business to secure forward contracts whilst the futures prices are low.

Futures Prices $/MWh / & Movement

| Region | Month Open | Month Close | Jan 2023 – Dec 2025 Avg | Dec 2025 | Jan 2023 – Dec 2025 |

|---|---|---|---|---|---|

| NSW | 110.48 | 104.33 | 118.64 | -5.6% | -10.4% |

| QLD | 89.93 | 85.68 | 97.25 | -4.7% | -11.0% |

| SA | 92.28 | 90.34 | 102.06 | -2.1% | -10.5% |

| VIC | 78.50 | 77.89 | 74.35 | -0.8% | +4.7% |

| NEM (Avg) | 92.80 | 89.56 | 98.07 | -3.5% | -7.7% |

State Electricity Update

New South Wales

Spot

NSW average spot prices finished December 2025 at $71.36/MWh, materially lower than $134.73/MWh in December 2024, representing a 47% year-on-year decline. Prices remained subdued through the month despite periods of warmer weather, reflecting strong supply availability and improved system flexibility.

Futures

| Contract | Month Open | Month Close | % Change |

|---|---|---|---|

| CY26 | 110.88 | 105.34 | -5.0% |

| CY27 | 110.59 | 104.34 | -5.7% |

| CY28 | 112.22 | 103.50 | -7.8% |

| CY29 | 112.51 | 103.74 | -7.8% |

| Average (CY26–CY29) | 111.55 | 104.23 | -6.6% |

Generation Mix

| Metric | Dec-24 | Dec-25 | Change |

|---|---|---|---|

| Total generation (GWh) | 6,663 | 6,527 | -2.0% |

| Renewable share (%) | 41.8% | 46.4% | +4.6% |

| Coal share (%) | 54.2% | 46.1% | -8.1% |

| Gas share (%) | 1.8% | 2.0% | +0.2% |

| Battery discharging (GWh) | 12.1 | 43.0 | +255.4% |

| Renewable curtailment (GWh) | 217 | 365 | +68.2% |

| Emissions (kgCO₂e/MWh) | 530 | 472 | -10.9% |

Victoria

Spot

VIC average spot prices finished December 2025 at $27.51/MWh, materially lower than $52.25/MWh in December 2024, representing a 47.3% year-on-year decline. Prices remained low through the month, supported by strong renewable output and increased system flexibility.

Futures

| Contract | Month Open | Month Close | % Change |

|---|---|---|---|

| CY26 | 76.83 | 75.00 | -2.4% |

| CY27 | 75.47 | 74.76 | -0.9% |

| CY28 | 79.59 | 77.87 | -2.2% |

| CY29 | 84.11 | 83.32 | -0.9% |

| Average (CY26–CY29) | 79.00 | 77.74 | -1.6% |

Generation Mix

| Metric | Dec-24 | Dec-25 | Change |

|---|---|---|---|

| Total generation (GWh) | 3,986 | 4,080 | +2.4% |

| Renewable share (%) | 50.8% | 52.4% | +1.6% |

| Coal share (%) | 55.8% | 52.1% | -3.7% |

| Gas share (%) | 1.6% | 1.1% | +0.5% |

| Battery discharging (GWh) | 20.4 | 78.0 | +282.4% |

| Renewable curtailment (GWh) | 250 | 447 | +78.8% |

| Emissions (kgCO₂e/MWh) | 577 | 564 | -2.3% |

Queensland

Spot

QLD average spot prices finished December 2025 at $54.38/MWh, well below $134.44/MWh in December 2024, representing a 59.6% year-on-year decline. Prices remained subdued through the month despite summer conditions, supported by improved supply availability.

Futures

| Contract | Month Open | Month Close | % Change |

|---|---|---|---|

| CY26 | 92.93 | 85.66 | -7.8% |

| CY27 | 91.46 | 86.26 | -5.7% |

| CY28 | 90.89 | 85.22 | -6.2% |

| CY29 | 91.72 | 85.09 | -7.2% |

| Average (CY26–CY29) | 91.75 | 85.56 | -6.7% |

Generation Mix

| Metric | Dec-24 | Dec-25 | Change |

|---|---|---|---|

| Total generation (GWh) | 5,898 | 5,902 | +0.1% |

| Renewable share (%) | 31.1% | 38.9% | +7.8% |

| Coal share (%) | 59.4% | 58.6% | -0.8% |

| Gas share (%) | 8.2% | 3.9% | +4.3% |

| Battery discharging (GWh) | 19.9 | 88.0 | +342.7% |

| Renewable curtailment (GWh) | 92 | 140 | +52.2% |

| Emissions (kgCO₂e/MWh) | 589 | 539 | -8.5% |

South Australia

Spot

SA average spot prices finished December 2025 at $27.92/MWh, materially lower than $61.47/MWh in December 2024, representing a 54.6% year-on-year decline. Prices remained subdued despite warm conditions, reflecting strong renewable output and continued system flexibility.

Futures

| Contract | Month Open | Month Close | % Change |

|---|---|---|---|

| CY26 | 92.18 | 88.41 | -4.1% |

| CY27 | 90.94 | 88.46 | -2.7% |

| CY28 | 92.04 | 91.11 | -1.0% |

| CY29 | 95.09 | 93.53 | -1.6% |

| Average (CY26–CY29) | 92.56 | 90.38 | -2.4% |

Generation Mix

| Metric | Dec-24 | Dec-25 | Change |

|---|---|---|---|

| Total generation (GWh) | 1,282 | 1,296 | +1.1% |

| Renewable share (%) | 78.9% | 80.7% | +1.8% |

| Coal share (%) | 0.0% | 0.0% | – |

| Gas share (%) | 15.7% | 9.4% | +6.3% |

| Battery discharging (GWh) | 14.4 | 40.0 | +177.8% |

| Renewable curtailment (GWh) | 156 | 249 | +59.6% |

| Emissions (kgCO₂e/MWh) | 161 | 146 | -9.3% |

Closing Commentary

December’s outcomes reinforce the continued easing of electricity market conditions, with lower spot prices and a further softening in futures reflecting growing confidence in system supply and flexibility. Increased renewable output, stronger battery participation and elevated curtailment continue to play a key role in reducing volatility and suppressing forward risk premiums.

With futures pricing now sitting below longer-term post-2023 averages across most regions, current conditions present a timely opportunity for energy users to review procurement strategies and consider opportunities to secure forward pricing while market confidence remains elevated.

Leading Edge Energy continues to monitor market developments closely. If you would like to discuss how current conditions may impact your contract position, budget outlook or risk profile, please contact your Leading Edge Energy representative to explore tailored strategies for the year ahead.

Explainer: Why we focus on Wholesale Futures Prices

Futures Price: This reflects what the market expects wholesale electricity spot rates to be in future periods. The offers that commercial and industrial (C&I) customers receive via Leading Edge Energy are closely correlated to wholesale prices on the ASX Energy futures market; this is why we focus on these prices in our commentary.

Wholesale Spot Price: This represents how much the spot market is charging for electricity currently based on demand and supply. Spot prices go up when demand is high and supply is tight.

You can learn more about the difference between wholesale electricity futures and spot prices in our blog section.

Disclaimer: The information in this communication is for general information purposes only. It is not intended as financial or investment advice and should not be interpreted or relied upon as such.

We source, analyse, compare and rank commercial, industrial and multi-site energy quotes. Obligation Free.

Chat with one of our experienced consultants today and get the insights your business needs to help manage the risks associated with volatile electricity and natural gas markets. Our energy procurement service is obligation-free and provides a time-saving way of securing lower energy rates from our panel of energy retailers.

Get advice from our Energy Management Consultants

Ewen Beard

Sales Manager

Get in Touch

Feel free to call or e-mail us. Or just fill in the form below and we’ll contact you for an obligation-free discussion.

Are you ready to save on business energy costs?

Get Started

Leading Edge Energy is proud to be a signatory of the National Customer Code for Energy Brokers, Consultants and Retailers.