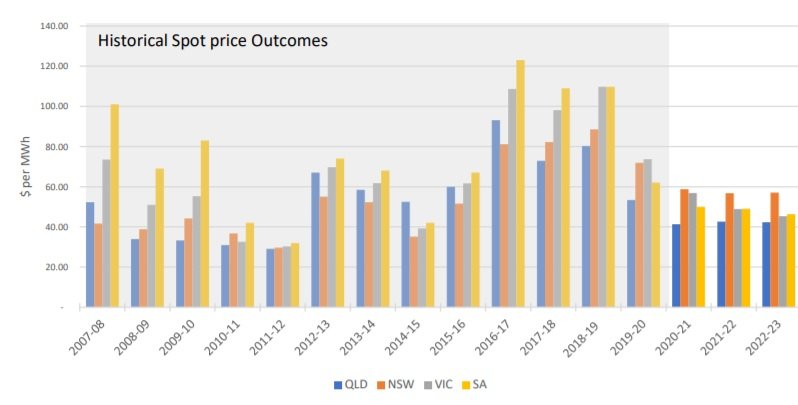

The volume of renewable energy generated, rooftop solar uptake, falling coal and gas prices and lower demand have all contributed to wholesale electricity spot prices, which are currently the lowest they have been since 2015.

The findings were announced in the Energy Security Board’s Health of the National Energy Market report which found that in some regions, prices are the lowest they have been in a decade.

(Read the Health of the NEM report’s Part 1 and Part 2 here.)

The same report finds that the trend will continue with current forward prices of between $40 and $60 per MW hour across all regions in the National Energy Market until 2023.

Activity beyond that date is still too sparse to gain any indication of what will happen after 2023.

The report states that continued uptake of rooftop PV and large-scale renewable energy generation will keep prices subdued, provided that firming measures are in place to make sure there is a reserve of dispatchable power through big batteries, rapid-release hydro and high-peaking gas plants to replace the retiring coal fleet.

If this happens, wholesale prices will remain at sustainable levels outside ‘renewable dominant periods’.

The ESB report findings were mirrored in the Australian Energy Regulator’s Wholesale Electricity Market Report in December 2020, which found that NEM prices have fallen to increased large-scale solar and wind generation.

The AER report also found that while prices have fallen, they remain sufficient to encourage further investment in new generation and storage.

Other findings in the report include:

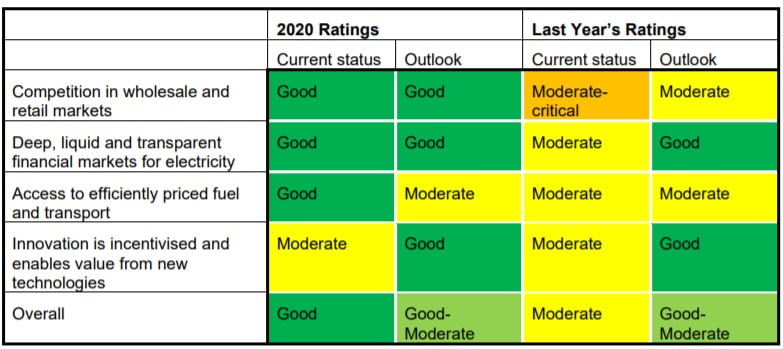

- The current transformation of the NEM has slightly lessened market concentration, as well as affected how participants offer their capacity, price signals for new investment and markets for managing fluctuations in frequency.

- Flexible generation is becoming more important in firming fluctuations in intermittent renewable generation and is now setting the price more often in peak demand periods.

- While the report did not find any concerning exercise of market power by generators there are still elements of the market that are vulnerable to the exercise of market power.

- The AER’s continued monitoring of the performance of the wholesale market, as it evolves, will need to focus on the implications for competition and efficiency of increased penetration of intermittent renewable generation and the role of flexible generation particularly in evening peaks. It will also need to monitor and report on how major policy reforms and interventions are changing competitive dynamics in the NEM.

Retail competition

Falling wholesale prices have continued to improve the growth opportunities for smaller retailers, as the costs of holding and managing hedging positions reduce.

The most recent retail electricity market share data shows that Tier 2 retailers continued to gain market share. This increase was spread across multiple retailers.

Coal prices tumble as production falls faster and sooner than envisaged

Coal prices also continued to tumble in 2020 and have been on a downward trend since late 2018.

Thermal coal prices have now hit levels that have not been seen since 2006 and several coal producers are now operating at levels that provide little to no financial return.

Many black coal-fired generators in the NEM increased their exposure to global coal pricing as long-term contracts rolled off in the mid-2010s.

The fall in coal prices since late 2018 has led to lower costs and lower spot price outcomes in the NEM.

This trend, however, has been partially offset by continued coal quality issues at a range of mines in NSW that have affected the amount of coal available to several of that region’s generators.

NSW is one of the most heavily coal-reliant states in the National Electricity Market.

In the recent 2020 World Energy Outlook, the IEA sees global coal production falling sooner and faster than it envisaged in 2019, however, Australian producers are likely to be more resilient to falling demand than other export-focused countries.

It is unlikely that coal prices can remain at current levels given the challenging financial situation for many producers. It is also concerning that the risk of continued coal quality issues could impact the availability of coal for generation in the NEM.

Combined, these issues present a risk to the upside concerning wholesale prices in the NEM.

Gas prices to recover by 2022

Like coal prices, gas prices have also fallen considerably since 2018 to levels not seen on the east coast since 2015-16 when oil prices fell to just under US$30 per barrel.

Currently, near-term gas prices across the domestic gas markets are trading in a range of $5-$6 per GJ. The current outlook for domestic gas prices is for a general trend back towards $6-$7 per GJ by 2022 as global gas markets recover from the impact of COVID-19.

Keep updated with the latest news in the energy industry

As an energy broker and consultancy firm, Leading Edge Energy always has an ear out for changes in wholesale electricity and gas prices and for ways to save money on energy costs. We do this to ensure that we can provide businesses in Australia with top-notch energy cost-reduction services.

Want to read more? Visit our Blogs and News section.

Or get started on saving your business money on your energy spend. Contact us at 1300-852-770 or email us at hello@leadingedgeenergy.com.au. Our Experts are ready to guide you!

We source, analyse, compare and rank commercial, industrial and multisite energy quotes. Obligation Free.

Chat with one of our experienced consultants today and get the insights your business needs to help manage the risks associated with volatile electricity and natural gas markets. Our energy procurement service is obligation-free and provides a time-saving way of securing lower energy rates from our panel of energy retailers.