Victoria’s Essential Services Commission (ESC) has announced a dramatic shift in the state’s solar feed-in tariffs (FiTs), with the minimum flat rate set to plunge from 3.3 cents per kilowatt-hour (kWh) to just 0.04 cents per kWh—effectively zero—from July 1, 2025. Time-varying FiTs will also drop, ranging from 0.0 to 7.5 cents per kWh. For large energy users with on-site solar, this means a fundamental change in strategy. The days of relying on feed-in payments to offset energy costs are over; businesses must focus on maximizing on-site consumption, load shifting, and energy storage to get the most out of their solar investments.

So, what’s driving these changes, and how should businesses respond? Let’s explore the history of FiT reductions, the impact of wholesale energy prices, and the best strategies to mitigate financial losses.

The Historical Decline of Feed-In Tariffs

Over the past few years, Victoria’s solar FiTs have steadily declined, reflecting shifts in the wholesale electricity market and the growing penetration of solar across the state. In 2017, businesses could expect FiTs as high as 11.3 cents per kWh. Since then, rates have progressively dropped:

| Calendar Year | Flat Feed-in Tariff (c/kWh) | Daytime FiT (c/kWh) | Early Evening FiT (c/kWh) | Overnight FiT (c/kWh) |

|---|---|---|---|---|

| 2019-2020 | 12.0 | |||

| 2020-2021 | 10.2 | |||

| 2021-2022 | 6.7 | |||

| 2022-2023 | 5.2 | 4.4 | 9.3 | 11.3 |

| 2023-2024 | 3.3 | 2.8 | 7.0 | 7.6 |

| 2025-2026 | 0.04 (projected) | 0.0 | 5.85 | 7.5 |

This downward trend is a direct result of fundamental shifts in the energy market. The more solar power that floods the grid, the less valuable that exported energy becomes. But why exactly is the rate now approaching zero?

Why is the Feed-In Tariff Near Zero?

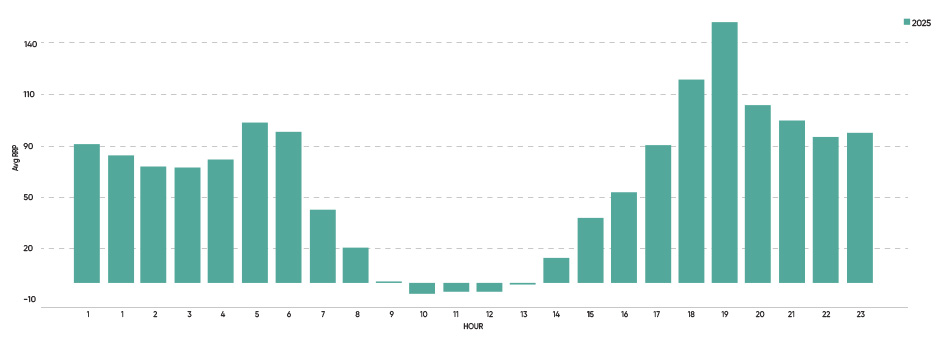

The primary driver behind this collapse is the wholesale electricity price dynamics, particularly the impact of the “duck curve.” As more businesses and households install solar panels, the market sees an oversupply of electricity during daylight hours, driving spot prices lower—sometimes even negative.

- High solar penetration: With nearly 800,000 rooftop solar systems now active in Victoria, supply is exceeding demand during peak generation periods (midday to early afternoon).

- Wholesale price crashes: Energy retailers and market operators no longer need to pay for excess solar generation when the spot price is already at or below zero.

- Grid congestion: Overproduction in certain regions is leading to constraints in how much power can be exported, reducing the financial viability of selling excess energy back to the grid.

This economic reality explains why FiTs have been declining steadily and why businesses must now rethink their approach to solar investments.

How Large Energy Users Should Respond

With the FiT system no longer providing meaningful returns, large energy users must take a proactive approach to managing their solar investments. Here’s how:

1. Explore Load Shifting Strategies:

- Align high-energy processes (e.g., manufacturing, refrigeration, HVAC operations) with peak solar generation times to consume more power on-site rather than exporting it for near-zero returns.

2. Consider Battery Storage Investments:

- Storing excess solar energy allows businesses to shift their usage to peak pricing periods, reducing reliance on grid power when costs are high.

3. Optimize Your Energy Procurement Strategy:

- We provide businesses with tailored energy procurement strategies that incorporate solar generation, demand response opportunities, and cost-effective supply contracts.

Trends in Other States

While Victoria’s FiTs are regulated, many other Australian states do not have set minimums for large energy users. Instead, retailers determine feed-in rates based on a business’s meter data, historical export quantities, and spot market prices. This means:

- Large energy users in states like New South Wales, Queensland, and South Australia already deal with fluctuating FiT offers that vary depending on wholesale spot market trends.

- The general trend is the same, daytime FiTs are declining lower & lower.

- Some retailers may offer higher FiTs during peak demand periods but very little for daytime exports when solar oversupply occurs.

- Businesses in Victoria should prepare for a future where feed-in rates are market-driven, emphasizing the importance of retailer selection and contract negotiation.

Understanding this trend can help businesses in Victoria adapt by taking a more strategic approach to energy procurement and export management.

Take Action Now

The sharp decline in solar feed-in tariffs marks a new era for large energy users in Victoria. Businesses can no longer depend on export payments as a revenue stream but must instead shift focus to self-consumption, load optimization, and storage solutions to maximize returns on their solar investments.

Our team specializes in helping businesses navigate these changes, ensuring they secure the best energy deals, implement strategic load shifting, and explore the feasibility of on-site storage solutions. If you want to stay ahead of the curve, reach out to us today for a comprehensive solar and energy strategy review.

—

Leading Edge Energy can help you secure stable, competitive rates so energy price spikes don’t affect your bottom line.

Let’s chat. Call us at 1300-852-770 or email us at info@leadingedgeenergy.com.au.

You may also sign up for an obligation-free consultation by responding to our form. Click the button below.

We source, analyse, compare and rank commercial, industrial and multi-site energy quotes. Obligation Free.

Chat with one of our experienced consultants today and get the insights your business needs to help manage the risks associated with volatile electricity and natural gas markets. Our energy procurement service is obligation-free and provides a time-saving way of securing lower energy rates from our panel of energy retailers.