As rooftop solar, commercial solar, wind and batteries take a more prominent role in electricity markets, price cannibalisation is becoming more frequent. This has radically altered how electricity is traded.

Price Cannibalisation refers to the phenomenon experienced when renewable energy sources, including small and large-scale solar and wind, generate an oversupply of electricity.

The oversupply of electricity can end up causing a drop in electricity prices within the market. This occurs when renewable sources with similar generation patterns (for example, producing energy on sunny and windy days) flood the market with power, driving down prices.

In some cases, prices may even dip into the negative territory, meaning that producers might have to pay consumers to take the excess electricity off their hands.

As more renewables come online, this is something that the National Energy Market (NEM) is experiencing more frequently, especially in South Australia, which can sometimes experience renewable penetration rates of over 80 per cent.

Investor Challenges in the Face of Price Cannibalisation

The impact of price cannibalisation is broad and diverse, with significant implications for investors, particularly those engaged in large-scale renewable energy projects.

When electricity prices crash to near zero or hit negative levels, it becomes financially less attractive for investors to operate and maintain their projects, potentially affecting their returns on investment.

Rooftop Solar vs. Utility-Scale Solar: A Key Player in Price Cannibalisation

Rooftop solar installations are distributed solar systems scattered across homes and businesses.

They play a pivotal role in driving this phenomenon. They often align their power production with that of utility-scale solar farms. Also, in many cases, people are out at work during the peak hours of solar generation, meaning that they are generating electricity and using it minimally.

Home battery packs also allow them to build a store of energy and sell off the surplus. The stored energy can then be used during peak times when power is expensive (when it is dark and still) or sold onto the grid at more favourable rates.

Rooftop solar systems come with some distinctive advantages: Rooftop solar systems go beyond simply selling excess electricity at wholesale prices.

Homeowners and businesses can put their home-generated energy to good use, trimming down their electricity bills. Moreover, they can even participate in programs like net metering, selling surplus power back to the grid at retail rates.

Price Cannibalisation in the Australian Electricity Market

Australia’s National Electricity Market (NEM) provides clear examples of price cannibalization.

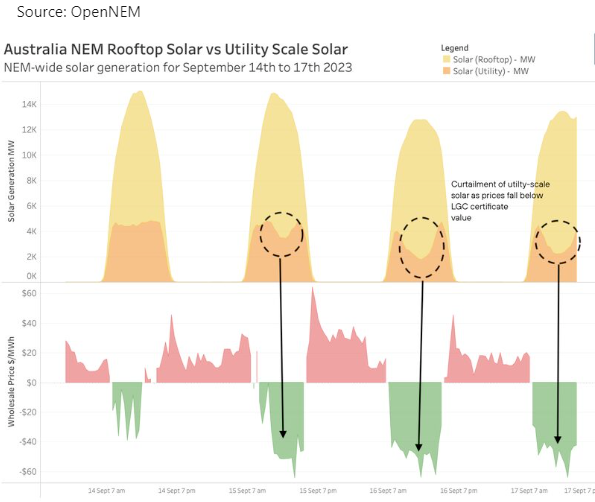

The graphic shows the combined output of rooftop and utility-scale solar and wholesale electricity prices.

In this representation, yellow and orange portions indicate solar generation, red denotes prices above $0 (meaning positive prices), and green represents prices dipping below $0 (entering negative territory).

Dominance of Distributed Solar in Australia

Distributed solar, or rooftop solar, holds a dominant position in Australia when compared to utility-scale solar.

This trend shows no signs of abating and could emerge in other markets.

Price cannibalisation is a challenge born out of the expansion of renewable energy, particularly solar power. It can impact the financial viability of utility-scale renewable projects in the electricity market. With its unique characteristics, Rooftop solar stands as a significant contributor to this phenomenon in Australia.

The Ripple Effects on Futures Pricing

Price cannibalisation can influence futures pricing, albeit in a limited and somewhat variable manner, depending on market conditions and regulatory frameworks. Here’s how it can affect futures pricing:

Increased Spot Price Volatility

Price cannibalisation can lead to heightened volatility in the spot market. When renewable energy generation soars and prices dip into negative territory, it creates a sense of uncertainty in the short-term market. This volatility can impact traders’ risk perceptions and influence their decisions in the futures market.

Impact on Forward Contracts

Market participants trading electricity futures contracts often consider spot market conditions when shaping their pricing strategies. If they anticipate that price cannibalisation will persist, it could affect the terms and pricing of future contracts.

Risk Mitigation Strategies

Market participants may recalibrate their risk mitigation strategies when dealing with electricity futures to tackle the risks linked to price cannibalisation. This may include opting for more flexible contracts or integrating risk premiums into their pricing models.

Market Adaptations

As price cannibalisation becomes more recognised as a prevalent phenomenon, electricity markets and regulatory bodies might adapt to address these challenges.

This could involve deploying mechanisms for improved supply and demand balance or conceiving new market products tailored to hedge against price volatility caused by renewables.

Evolution in Market Design

Electricity markets could undergo structural changes to accommodate the growing influence of renewables.

This could encompass amendments to market rules, such as introducing more dynamic pricing mechanisms or incorporating greater flexibility into contract terms.

Government Policies and Incentives

Government policies and incentives can play a pivotal role in shaping futures pricing. Subsidies, feed-in tariffs, and other policy measures can sway the profitability of renewable projects, indirectly impacting supply dynamics and futures pricing.

Investor Confidence

The extent to which price cannibalisation affects investor confidence in the renewable energy sector can also influence futures pricing. A perception of stability and supportive regulatory and market conditions can encourage more significant investment in renewables, potentially affecting supply and pricing.

Direct impact on futures pricing is limited

While price cannibalisation can introduce some volatility and uncertainty into electricity markets, its direct impact on futures pricing is limited.

Futures pricing is shaped by a complex interplay of factors, encompassing supply and demand dynamics, regulatory conditions, investor sentiment, and market participants’ strategies.

Price cannibalisation is just one of the numerous factors that can steer futures pricing, with its effects possibly being tempered by market adaptations and risk management approaches.

Unstoppable Solar Power Despite Price Cannibalisation

Despite the challenges that price cannibalisation presents to investors in utility-scale solar projects, it is improbable that the installation and generation of solar power will grind to a halt. Several compelling reasons support this assertion as follows:

Environmental Benefits

Solar power emerges as a clean and renewable energy source, holding the ability to reduce greenhouse gas emissions and contribute to the battle against climate change.

Many individuals, businesses, and governments prioritise solar installations for their profound environmental benefits.

This dedication to sustainability often outweighs the short-term financial hurdles brought about by price cannibalisation.

Energy Independence

Solar power ushers in the prospect of energy independence for homeowners and businesses.

By generating their electricity, they can reduce their dependence on the grid and slash their energy bills.

This facet of energy self-sufficiency is a compelling motivator for solar adoption.

Government Support

Many governments extend incentives and subsidies to promote solar installations. These incentives can encompass tax credits, feed-in tariffs, and rebates, rendering solar more cost-effective and appealing.

Technological Advancements

Advancements in solar technology, such as heightened efficiency and energy storage options, are rendering solar installations more economically viable, even in the face of price cannibalisation.

Energy storage solutions, such as batteries, empower solar system owners to store excess energy and utilise it during periods of low generation or surges in electricity demand.

Long-Term Perspective

Solar projects often come with substantial lifespans, typically exceeding 25 years.

Investors and homeowners usually adopt a long-term view, weighing the overall financial benefits and energy security over the system’s lifetime rather than reacting to the short-term.

–

Considering investing in a solar project for your business but don’t know where to start? Our energy management consultants can guide you. Get in touch with us at 1300 852 770 or admin@leadingedgeenergy.com.au and let’s discuss your options for solar power in the commercial and industrial setting, as well as other opportunities for optimising and managing your energy consumption and costs.