Throughout April 2021, the energy transition continued to send shockwaves through the energy industry – even as low wholesale prices showed signs of reversing. This month saw three sudden departures of high-profile energy CEOs. AGL’s Brett Redman jumped ship just weeks after announcing AGL’s split while Stanwell’s Richard Van Breda was pushed out after suggesting the mothballing of two coal-fired power plants due to the influx of cheap renewables. Energy Australia boss Catherine Tanna will also step aside. Meanwhile, wholesale prices are on the way up, having recovered from the January dip, and are now largely trading at December levels. Need help navigating the chaos?

Reach out to one of our energy experts now.

| Indicative Rates | NSW | VIC | QLD | SA |

| Peak | 6.5c/kWh | 4.97c/kWh | 5.6c/kWh | 5.2c/kWh |

| Off-Peak | 4.5c/kWh | 3.45 c/kWh | 3.9c/kWh | 3.59c/kWh |

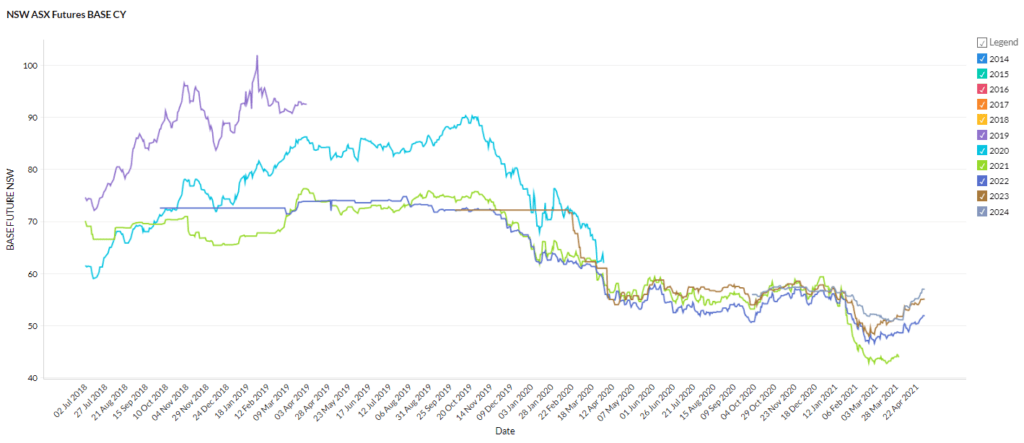

New South Wales

- Futures rose steadily throughout April reversing the latest dip that began at the start of the year.

- 2022 and 2023 rose ~7% to $52 and $55/MWh respectively.

- 2024 contracts shot up 11.5% to $57/MWh.

How did supply and demand affect price?

- Spot prices ranged from -$42 to $2,674/MWh with soft demand typical of Autumn.

- Energy Australia has approved a gas power plant for NSW to provide dispatchable power to complement surging renewables.

- The 300MW plant will come online after the closure of Liddell and will be able to be switched to green hydrogen when that fuel becomes commercially available.

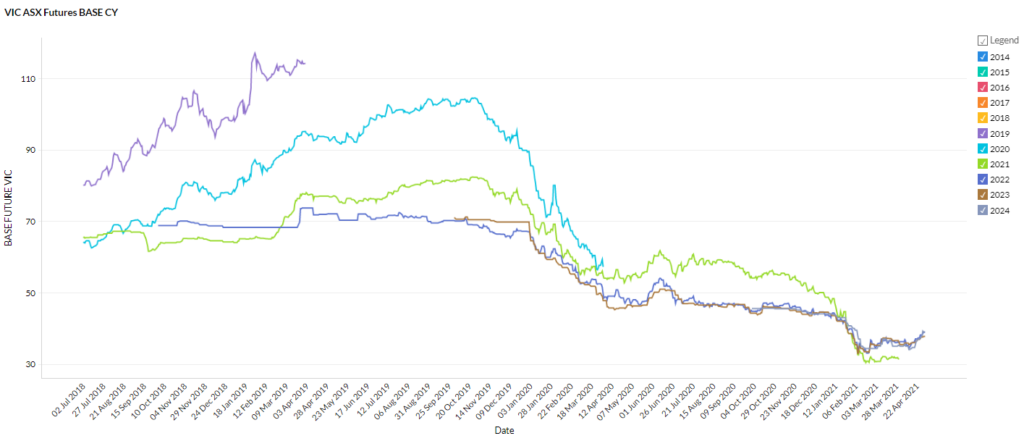

Victoria

- Victoria’s price movements were similar to NSW with 2022 and 2023 rising ~7% and 2024 rising 11% over April.

- Futures contracts are trading between $37 and $39/MWh which are still remarkably low prices compared to historic averages.

How did supply and demand affect price?

- Demand was soft and prices went negative regularly during the daylight hours.

- Prices were relatively stable ranging from -$70/MWh to $330/MWh.

- Victoria was the major contributor of wind power to the NEM on the record breaking night of April 13 when wind output peaked at 5,430MW. Nearly half (2,384MW) came from Victoria.

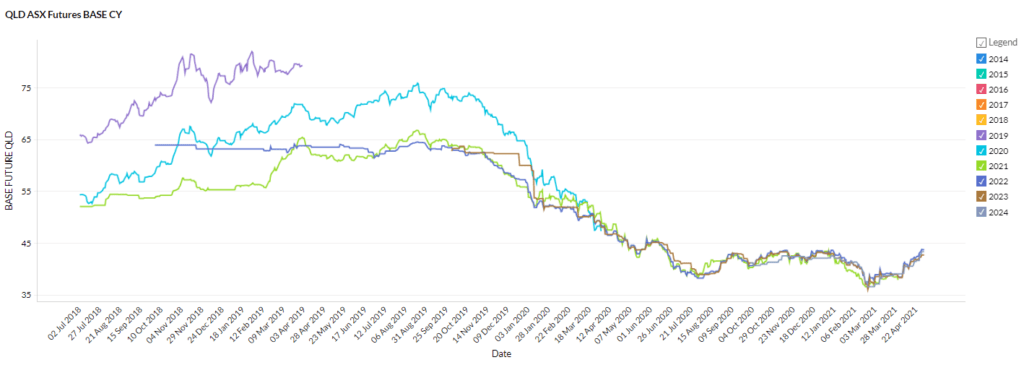

Queensland

- Queensland experienced steep price rises with 2022 spiking 14% to $44/MWh and 2023 and 2024 rising 11% to ~$43.50/MWh.

- The reversal has brought prices back to December levels but prices are still very low compared to historic averages.

How did supply and demand affect price?

- Queensland has continued to experience increased volatility and spot price spikes.

- Prices ranged from -$180 to $2,507/MWh with prices demonstrating the effects of an enhanced duck curve.

- The volatility of the energy transition was echoed by the events at Stanwell – the Queensland Government-owned energy company- this month when its CEO was ousted for discussing the reality that coal plants are being pushed out by surging renewables.

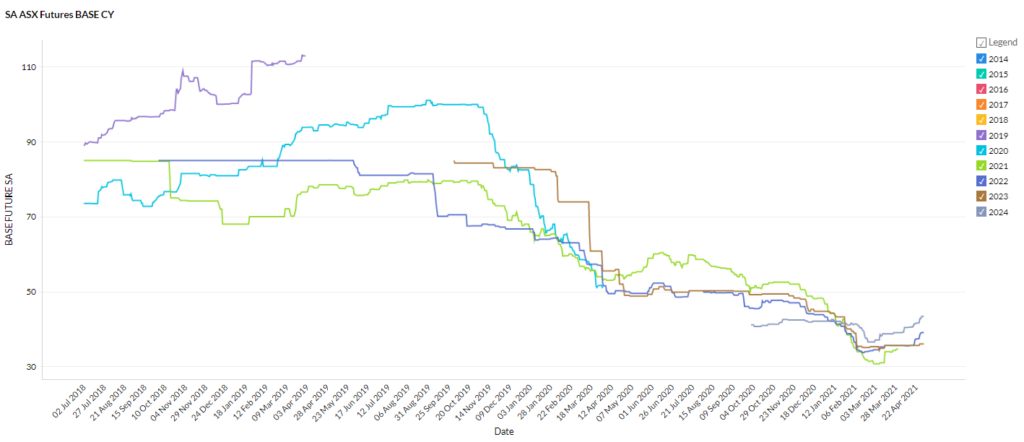

South Australia

- South Australia’s 2022 and 2024 contracts rose 10% and 11% respectively.

- 2023 was the only contract to be immune from the NEM wide price rises flatlining around $36/MWh throughout April.

- 2022 and 2024 are trading at $29 and $43/MWh respectively.

How did supply and demand affect price?

- There were plenty of negative spot prices during the daylight hours with around 150 price intervals at or below $0/MWh.

- SA followed Victoria as the second-largest contributor to the record wind output on April 13 contributing 1,273MW which equated to 84% of its own demand at the time.

- AEMO’s recently released Quarterly Dynamics Report found that renewables reduced SA’s average quarterly price down $10/MWh and resulted in a negative average price during the day – a first for any NEM jurisdiction.

April 2021 marked the first consistent period of widespread energy price rises since 2019. Renewable output records continued to tumble and the shakeup among Australia’s energy leadership gained steam. A disorderly exit of incumbent generators threatens increased price volatility and decreased energy security. We can help your business lock in price certainty to ride out the bumpy road ahead. Reach out to us now!

Disclaimer: The information in this communication is for general information purposes only. It is not intended as financial or investment advice and should not be interpreted or relied upon as such.