Australia’s uptake of rooftop solar by both households and businesses is largely viewed as positive, but it can also put the National Energy Market at risk in terms of problems caused by low minimum operational demand.

In fact, South Australia and Western Australia have passed legislation to allow the NEM/WEM to deliberately trip rooftop solar PV as a last resort in the event of minimum demand dropping too low.

If operational demand drops too low, it can cause significant damage to grid infrastructure, which could cause network tariffs to increase as a result of increased maintenance and repairs.

What is minimum operational demand?

But what is minimum operational demand? Operational demand, put simply, is the total amount of energy that is supplied to consumers from the national energy grid.

This includes energy produced from solar farms, wind farms as well as traditional fossil fuel generation plants.

Minimum Operational Demand means the lowest level of energy demanded from the grid on any metric, i.e. any given day, week, month, or year.

Minimum operational demand is affected by a number of factors including weather conditions, which can push demand up or down if it is very hot or cold.

This is because households resort to using air conditioning, which has a significant impact on demand.

Other factors include economic activity.

Interestingly, the COVID-19 restrictions have not impacted operational demand that much and reduced industrial activity has been offset by the increased demands brought about by the increased number of people working and schooling from home.

But the factor which influences operational demand the most is the uptake and use of rooftop solar-generated electricity.

When energy users’ needs are being met by their own generation through distributed energy resources (DER), particularly during the daylight hours, operational demand from the grid falls through the floor.

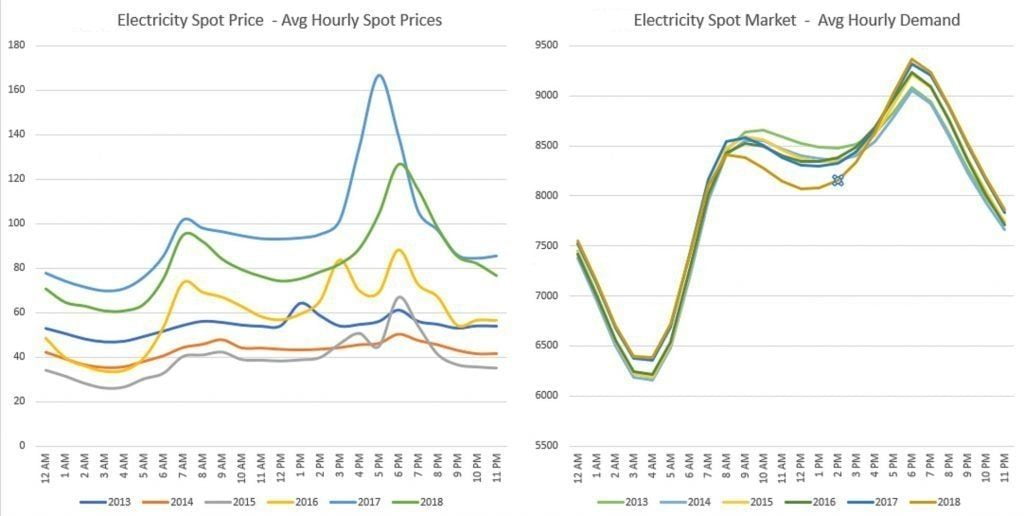

This creates what is known as the Duck Curve. As the illustration shows, operational demand is high in the morning as the sun’s rays are still weak.

At the same time, people are going through their daily routine, putting the kettle on, watching some morning news, listening to the radio etc.

But as people settle down into the later morning, the sun gets stronger and rooftop solar generation begins to ramp up in earnest.

As the sun sets, the opposite is true. Demand soars as heaters, ovens and other appliances are turned on.

Because there is no energy being generated through DERs, demand soars through the roof, creating very high electricity spot prices.

Home battery storage has started to offset this a little, but uptake is still too low to have any significant mitigation effect.

The issue is compounded by the fact that traditional power generators are affected by inertia, meaning that it takes a significant amount of time for them to ‘fire up’ and start generating electricity.

As a result they cannot be powered down and powered back up again to meet drastic increases in demand over a very short timestamp.

The electricity retail industry has tried to offset the problem by offering Solar Sponge Tariffs.

These are designed to be much cheaper than usual tariffs between 10 and 3 pm to encourage households to switch “variable” loads such as hot water heating, pool pumps, and other appliances to the middle of the day rather than at night.

This allows fossil-fuelled plants to continue to supply electricity to the grid which will actually be used.

The impact of solar on the grid and operational demand

Australia’s rooftop solar installations have skyrocketed over the past decade.

Rooftop solar supplies around 9GW of the country’s electricity which is the equivalent of 25 percent of total grid demand.

The Commonwealth Scientific and Industrial Research Organisation has forecast that solar will supply 60GW by 2050.

The current total capacity in the National Energy Market is 50GW and the average maximum demand sits at 35GW.

What are the challenges caused by minimum demand?

There are a number of issues which arise when minimum operational demand falls to low levels. These include:

- Voltage management – As demand levels decrease, managing voltage can become challenging. If more electricity is being pushed to the grid than is being used, infrastructure may be damaged. This can lead to a situation where the grid needs to be de-energised. South Australia and Western Australia have introduced laws to deliberately trip rooftop solar generation to prevent blackouts by forcing demand to be drawn from the grid. There are plans to introduce similar legislation in Queensland and Victoria. New South Wales also plans to introduce such legislation, but the state is not as susceptible to such issues as others.

- Islanding – Islanding is a situation that arises when states need to cut themselves off from the rest of the National Energy grid. South Australia and Queensland are particularly prone to resorting to operating as secure power generation islands. While in an island state, there needs to be enough demand for power generation units to stay on line and deliver power. Rooftop solar can interfere with islanding by forcing demand down.

- Emergency frequency control schemes – One of the last resorts to prevent under frequency disturbances is Under-Frequency Load Shedding. In this scenario, consumers are automatically disconnected from the grid. With more households using distributed solar, instead of drawing power from the grid, this ‘last resort’ mechanism becomes much less effective in managing severe disturbances.

- System restart – When a system restart is required, a minimum quantity of stable load is required after a major blackout. With large quantities of distributed solar PV operating, there may not be enough stable load.

What can be done to mitigate the challenges?

Experts believe that with prompt action at a regulatory level, it should be possible to continue to maintain power system security while also supporting a transition to greater amounts of DER.

Technology is also developing and evolving and no doubt, innovation will drive solutions to enter the market and address the challenges posed by minimum operational demand.

Large scale commercial batteries, for example, can be used as a ‘solar soak’ to store excess PV generation.

With active management of storing DER and solar PV, opportunities are arising for stakeholders and industry players to introduce new products and services into the market to create new, flexible options for grid management.

AEMO is working with industry, jurisdictions, the Energy Security Board (ESB), and market bodies to develop new standards to support cost-effective regulatory and market reforms that are required to keep the power system secure and reliable.

AEMO’s action plan includes introducing:

Disturbance ride-through capabilities – Thus measure includes a requirement for all new DER installed can keep operating through disturbances, by improving performance standards and enforcing compliance with those standards.

Emergency Solar PV shedding capabilities – to require as a condition of connection that all new distributed solar PV, of any capacity, could be disconnected as a last resort, in rare circumstances if severe abnormal operational conditions arise, to protect the overall power system.

Leading Edge Energy is a commercial energy broker and consultancy based in Sydney, Australia. If you would like to control your business’ electricity or natural gas expenses and create more stability for your company especially during times of uncertainty, fill out our form today.

Or if you would like to know more about how Leading Edge Energy can help you reduce your commercial energy costs, call us at 1300-852-770 or send us an e-mail at hello@leadingedgeenergy.com.au.