As we approach the end of the financial year, the energy market is presenting a timely opportunity for savvy businesses to secure competitive electricity rates.

Spot prices in May 2025 increased from April, which is a typical seasonal shift as we move into cooler months and heating demand picks up. However, compared to May 2024, prices are actually lower — a sign that underlying market conditions remain relatively stable for now. At the same time, forward market prices (futures) have softened, suggesting retailers are still pricing in some optimism for the months ahead.

But this window may not stay open for long. Winter volatility is a known risk, with cold snaps, supply disruptions or network outages often causing sudden price spikes. Regulatory changes and tariff adjustments also tend to roll out around mid-year, adding further cost pressures for many energy users.

If your electricity contract expires any time in the next 18 months, now is a smart time to start testing the market. Waiting could leave your business exposed to less favourable market conditions, particularly if volatility returns.

At Leading Edge Energy, we help businesses navigate the energy market to reduce costs and improve decision-making. By combining deep market expertise with our scalable tender management platform, we deliver data-driven insights tailored to your energy usage—empowering you to secure competitive electricity and natural gas rates with confidence.

Talk to us today to take advantage of the EOFY energy window.

National Electricity Market

Electricity Futures Market

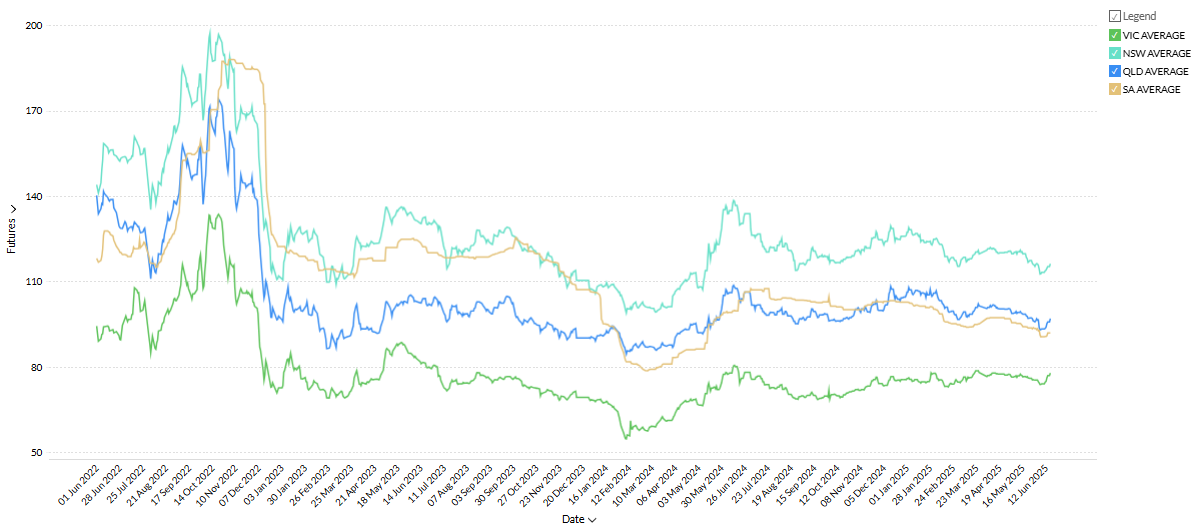

The national average electricity futures price settled at $95.44/MWh at the end of May, down from $98.36/MWh at the start of the month. That’s a modest month-on-month decline of $2.92/MWh, though still $8.75/MWh higher than the same period last year.

This mild monthly dip reflects softer trading conditions across the market, driven by:

- Lower autumn demand

- Consistent daytime solar output

- Stable grid performance across most regions

However, the year-on-year increase highlights the market’s ongoing exposure to systemic risks:

- Ageing thermal generation fleet

- Elevated gas prices

- Incomplete or delayed storage solutions

Even though coal outages were limited and no major weather events occurred in May, the futures curve remains firm — particularly in coal-dependent states — as traders continue to price in uncertainty around supply resilience heading into winter.

Electricity Spot Market

| Financial Year | NSW | QLD | SA | TAS | VIC | NEM (Avg) | Movement |

|---|---|---|---|---|---|---|---|

| 2023-24 | $101.57 | $87.80 | $78.56 | $69.07 | $63.29 | $82.81 | |

| 2024-25 | $116.20 | $103.47 | $91.10 | $100.06 | $71.52 | $95.57 | +12.77% |

In May 2025, the NEM recorded an average spot price of $95/MWh, up $3.50/MWh from April’s average of $91.50/MWh. This marks the third consecutive monthly increase, following $73.20/MWh in March, and points to growing pressure on the supply–demand balance as winter approaches.

For the financial year to date (FY2024–25), the average NEM spot price (excluding Tasmania) reached $95.57/MWh — a 12.77% increase from $82.81/MWh in FY2023–24.

This price uplift reflects:

- Broad recovery in wholesale pricing across key states, especially NSW and QLD

- Emerging signs of tighter system capacity heading into peak season

- Shifts in the generation mix that are pushing marginal costs higher

The data suggests that while market volatility has eased from crisis-era levels, structural cost pressures and winter risk factors remain in play.

State Electricity Markets

New South Wales

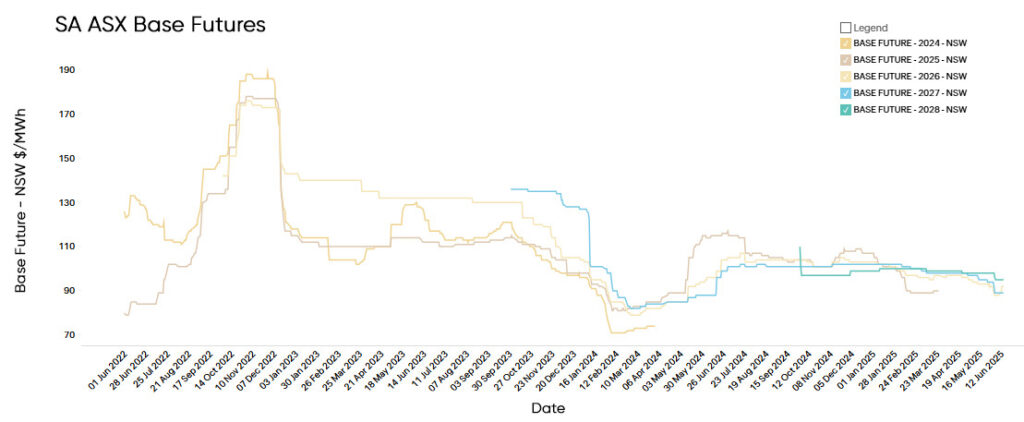

Electricity Futures Prices

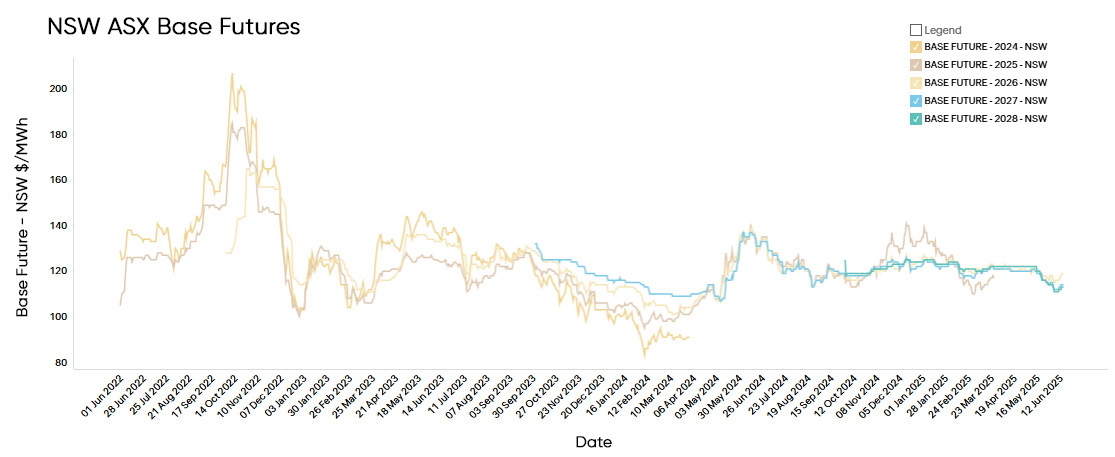

2026 in New South Wales began the month at $120.71/MWh, before softening to $117.53/MWh by the end of May.

Prices for 2027 and 2028 followed a similar trend, closing at $115/MWh and $114/MWh, respectively.

While futures are trending downward month-on-month, they remain well below the same period in 2024, when the market peaked at $136/MWh amid a major price spike. This year’s decline reflects greater near-term confidence, though underlying supply risks still shape the forward curve.

Electricity Spot Prices

Electricity spot prices in NSW rose sharply in May, climbing from $104/MWh at the end of April to $123/MWh by month’s end — a strong month-on-month increase reflecting tightening winter conditions.

Despite the recent rise, prices are still down 55% compared to May 2024, when the energy crisis saw spot prices peak at $273/MWh.

Additional pricing activity included:

- 5 market cap events, with pricing hitting $17,479/MWh

- 16 instances of prices exceeding $10,000/MWh

- Around 600 negative pricing intervals, with lows down to –$31/MWh

- The most frequent trading range was $70–$79/MWh, with 1,233 intervals falling into that band

This price spread illustrates continued volatility, with a mix of high caps and negative intervals shaping the intraday profile — even as the overall monthly average moved upward.

Energy Generation Mix

Renewable energy generation dropped from 33% to 32.5%. Of that 10.7% came from wind, 9% utility solar, 8% rooftop solar, 5% hydro, and 0.3% battery.

Coal dropped by a percentage point to make up 64% of generation while gas generation climbed by a percentage point to 3%.

Weighted average prices for each generation category in NSW for May 2025:

- Renewables (Solar, Wind, Hydro, Bioenergy): $99.93/MWh

- Coal: $133.18/MWh

- Gas (including Distillate): $258.11/MWh

- Battery (Discharging): $389.23/MWh

Victoria

Futures Prices

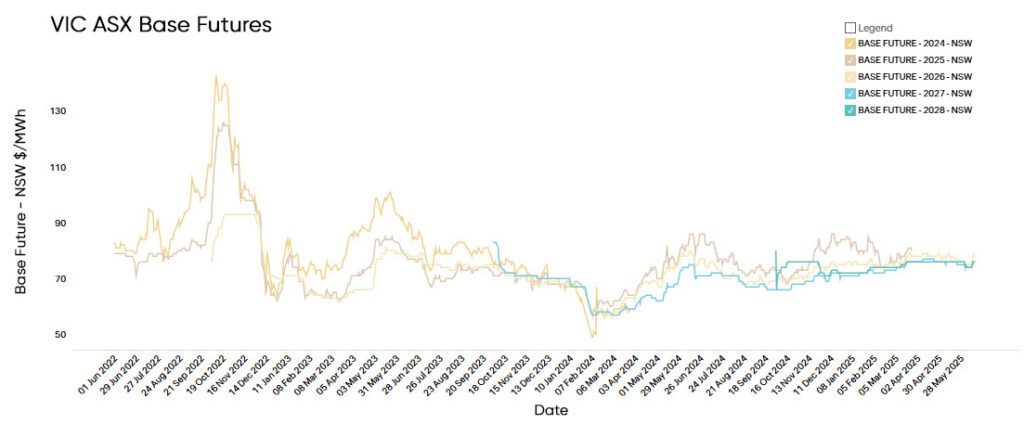

Electricity futures prices for 2026 in Queensland opened May at $77.75/MWh, declining steadily to $74.73/MWh by month’s end.

Prices for 2027 and 2028 followed a similar path, settling at $73.68/MWh and $74/MWh, respectively.

Compared to May 2024, when futures peaked at $77.98/MWh, current prices reflect a more subdued outlook — signalling improved short-term supply confidence, despite underlying structural risks that continue to shape market sentiment.

Electricity Spot Prices

Spot prices in Victoria edged higher in May, rising from $74.76/MWh at the end of April to $78/MWh by month’s end.

Despite this increase, prices remain 44% lower than in May 2024, when the energy crisis drove average prices to $133/MWh.

Overall, pricing conditions were relatively calm throughout the month:

- The market high reached $909/MWh

- There were 9 instances of prices exceeding $500/MWh

- Around 1,500 negative pricing events, with a low of –$63/MWh

Trading was notably concentrated at the bottom end of the price curve — with 814 intervals falling in the $0–$9/MWh band — reflecting Victoria’s strong renewable penetration and midday supply surplus.

Electricity Spot Prices

Renewable energy generation dropped from 38% to 37%. Of that 20% came from wind, 3.2% utility solar, 7.6% rooftop solar, 6.3% hydro, and 0.8% battery.

Coal dropped by a percentage point to make up 60% of generation while gas generation climbed significantly from 0.6% to 2.1%.

Weighted average prices for each generation category in Victoria for May 2025:

Energy Generation Mix

Renewable energy generation dropped from 38% to 37%. Of that 20% came from wind, 3.2% utility solar, 7.6% rooftop solar, 6.3% hydro, and 0.8% battery.

Coal dropped by a percentage point to make up 60% of generation while gas generation climbed significantly from 0.6% to 2.1%.

Weighted average prices for each generation category in Victoria for May 2025:

- Renewables: $53.16/MWh

- Coal: $89.45/MWh

- Gas: $163.13/MWh

- Battery (Discharging): $144.65/MWh

Queensland

Electricity Futures Prices

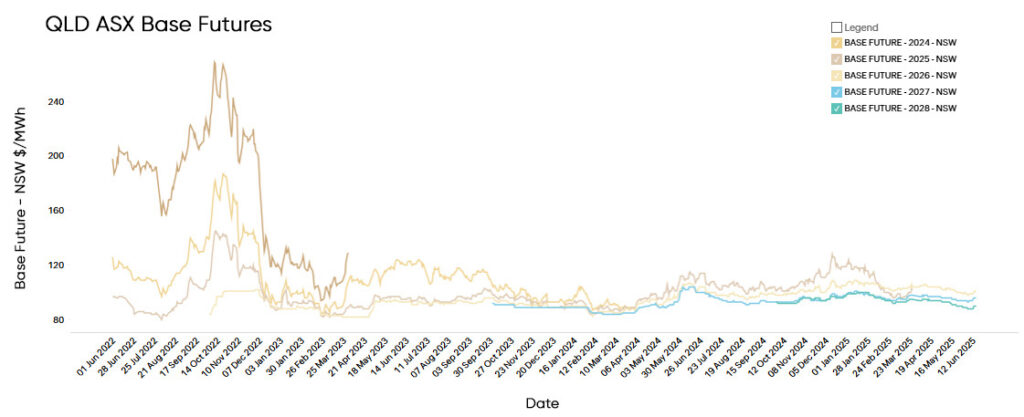

Electricity futures prices for 2026 in South Australia started the month at $103/MWh, falling steadily to close at $99.69/MWh by the end of May.

Prices for 2027 and 2028 mirrored this trend, ending the month at $94/MWh and $77.75/MWh, respectively.

Compared to May 2024, when 2026 futures were priced at $103/MWh, current prices represent a 3.1% decline — a modest shift that reflects improved supply outlooks while maintaining caution around market risks specific to South Australia’s unique generation mix.

Electricity Spot Prices

Spot prices in Queensland eased slightly over the month, falling from $98.50/MWh in April to $95.63/MWh by the end of May.

On a year-on-year basis, prices were up 3.17% from $92.69/MWh in May 2024, reflecting a modest upward shift in the broader wholesale trend.

Market volatility persisted throughout the month:

- 2 market highs reached $9,998/MWh

- 13 instances of prices exceeding $1,000/MWh

- Around 800 negative pricing events, with 6 intervals hitting –$33/MWh

Trading activity was heavily concentrated in the lower range, with 814 intervals recorded between $0–$9/MWh, underscoring the ongoing influence of daytime solar generation and mid-merit oversupply.

Energy Generation Mix

Renewable energy generation dropped from 32% to 28%. Of that 10.8% came from rooftop solar, 8.3% utility solar, 6.4% wind, 2.8% hydro, and 0.5% battery.

Coal climbed from 63% to 65% of generation while gas generation also increased from 5% to 6.6%.

Weighted average prices for each generation category in Queensland for May 2025:

- Renewables (Solar, Wind, Hydro, Bioenergy): $60.35/MWh

- Coal: $104.57/MWh

- Gas (including Distillate): $145.65/MWh

- Battery (Discharging): $171.93/MWh

South Australia

Electricity Futures Prices

Electricity futures prices for 2026 in South Australia began May at $95.60/MWh, falling steadily to $92.39/MWh by month’s end.

Prices for 2027 and 2028 closed at $94/MWh and $97/MWh, respectively.

Compared to May 2024, when 2026 futures were priced at $94/MWh, this reflects a 1.71% year-on-year decrease. While the change is marginal, it points to slightly softer trading sentiment — though longer-dated pricing still reflects caution heading into the peak demand period.

Electricity Spot Prices

Spot prices in South Australia fell from $89/MWh at the end of April to $83/MWh by the end of May.

Compared to May 2024, when prices were averaging $131/MWh, this marks a sharp 37% year-on-year decline — underscoring a cooler, more stable wholesale market environment heading into winter.

May was relatively calm by South Australian standards:

- High of $937/MWh

- 10 instances of prices exceeding $500/MWh

- 1,736 negative pricing events, with a low of –$161/MWh

- 100 intervals recorded below –$100/MWh

The most common price band was –$21 to –$12/MWh, with 857 intervals — reflecting sustained midday oversupply, likely driven by strong rooftop solar output and limited flexible demand.

Energy Generation Mix

Renewable energy generation dropped from 75% to 70%. Of that 46.6% came from wind, 17.2 % rooftop solar, 6.4% utility solar.

Gas generation increased from 23% to 27.7%.

Weighted average prices for each generation category in South Australia for May 2025:

- Renewables: $48.76/MWh

- Battery (Discharging): $147.64/MWh

- Gas: $140.29/MWh

- Distillate: $412.00/MWh

Market Stories & Updates: Winter 2025 Snapshot

Victoria’s Solar Feed-in Tariff Falls to Record Lows — What Large Energy Users Need to Know

Victoria’s minimum solar feed-in tariff (FiT) will drop to just 3.3c/kWh from July 1, 2025 — the lowest since the scheme began.

Gas Network Tariffs: What to Expect from July 2025

Australian Gas Networks (AGN) has received approval from the AER for 2025–26 tariff changes, aligned with its 2023–28 access arrangement. These reflect adjustments for operating and capital expenditures.

Multinet Gas has also released new tariffs effective July 1, 2025. Key points:

- Residential (Metro): Daily charge of $0.2187 (ex. GST); variable usage-based charges

- Non-residential: Daily charge of $0.3608; declining volume charges as daily usage increases

Now is the right time for gas users to review their current contracts and consumption patterns to identify opportunities for cost control.

Default Market Offer (DMO) 2025–26: Regional Impacts

The AER has finalised DMO prices for NSW, SE QLD, and SA, effective July 1, 2025:

- NSW: Residential increases of 8.3%–9.7%; small business up to 8.5%

- SE QLD: Residential increases of 0.5%–3.7%; small business up to 4.2%

- SA: Residential increases of 2.3%–3.2%; small business up to 3.2%

These rises are linked to elevated wholesale contract prices, network costs, and increased retail operating expenses.

Victorian Default Offer (VDO) 2025–26 Finalised

The ESC has confirmed new VDO pricing for July 2025 to June 2026:

- Residential: Average 1% annual bill increase

- Small business: Average 3% increase

Cost drivers include higher wholesale and network costs, with some offset from reduced environmental scheme charges. The ESC also adjusted its pricing methodology, notably lowering the allowed retail operating margin.

Infrastructure & Climate Signals to Watch

- Marinus Link Funding Secured

The $3.8 billion Tasmania–South Australia interconnector has received full financial backing, with construction expected to begin late 2025. This long-term project will reshape pricing dynamics and inter-regional supply. - $80 Million for Long-Duration Storage Trials

ARENA has approved funding for multiple 8+ hour battery trials in VIC and SA. These projects are expected to support evening peak reliability and influence forward contract sentiment over the next 2–3 years. - La Niña Watch Issued

The Bureau of Meteorology has increased its La Niña risk outlook. Should this pattern develop, it could bring sustained cloud cover and higher rainfall across eastern Australia — reducing solar generation and elevating evening demand volatility.

Take Control of Your Energy Costs

There is a lot of activity in the wholesale futures market as the new calendar year starts. Many businesses and industrial energy users are going to the market to make forward purchases of wholesale electricity while prices are relatively soft.

It is worth observing that businesses can go to the market to secure a new contract in advance, even if their current electricity contract is still in effect.

Depending on your business’s risk appetite, now could be a good time to secure a new energy contract.

Act now! Reach out to one of our experienced energy consultants today and gain valuable insight into the potential costs that may lie ahead. Don’t wait—take control of your energy expenses now!

We hope you have found our electricity market update for February 2025 informative and helpful. We understand that these are challenging times, and we are here to support you. If you’d like to delve deeper into the energy market’s previous months, you can find our monthly energy market reviews here.

Why Choose Us?

Expert Advice: Our team of energy consultants has in-depth knowledge of the energy market and can provide tailored advice to suit your business needs.

Cost Savings: Learn how to reduce your electricity costs and improve your business’s energy sustainability.

Proactive Planning: Stay ahead of market changes and make informed decisions with our comprehensive market updates.

Contact our team for advice on reducing electricity costs and improving your business’ energy sustainability. We are here to assist you and explore your options together.

Explainer: Why we focus on Wholesale Futures Prices

Wholesale Futures Price: This reflects what the market expects wholesale electricity spot rates to be in future periods. The offers that commercial and industrial (C&I) customers receive via Leading Edge Energy are closely correlated to wholesale prices on the ASX Energy futures market; this is why we focus on these prices in our commentary.

Spot Price: This represents how much the spot market is charging for electricity currently based on demand and supply. Spot prices go up when demand is high and supply is tight. You can view live Spot Prices here.

You can learn more about the difference between wholesale electricity futures and spot prices in our blog section.

Disclaimer: The information in this communication is for general information purposes only. It is not intended as financial or investment advice and should not be interpreted or relied upon as such.

We source, analyse, compare and rank commercial, industrial and multisite energy quotes. Obligation Free.

Chat with one of our experienced consultants today and get the insights your business needs to help manage the risks associated with volatile electricity and natural gas markets. Our energy procurement service is obligation-free and provides a time-saving way of securing lower energy rates from our panel of fifteen energy retailers.