Futures prices in the April 2022 energy market have been on a wild ride with record highs and sharp reversals making it hard to keep up. A divide is opening up between the northern and southern states with fuel mix, outages and grid constraints driving the divergence. Across the NEM prices are up 141% on last year however NSW and QLD are bearing the brunt of the pain. Global demand for black coal and gas is soaring and the fuel mix has never been a more important indicator of price. Our interactive online tools can help you understand your state’s position and plan for the future. And, as always, our Energy Experts are available to turn your plan into action.

| INDICATIVE RATES | NSW | QLD | VIC | SA |

| PEAK | 15.11 | 13.12 | 8.53 | 12.50 |

| OFF-PEAK | 10.45 | 8.58 | 5.54 | 7.60 |

New South Wales

- New South Wales futures contracts have gone through the roof.

- 2023 contracts fell 25% mid-month before heading north and finishing the month at a massive $129/MWh.

- 2024 and 2025 contracts are trading above $100/MWh after spiking in mid-February.

- All contract periods are at record highs.

How did supply and demand affect price?

- The volume-weighted average spot price has soared to $194/MWh nearly doubling from last month.

- A divide is opening up between the northern and southern states with NSW and QLD hit hardest by high prices.

- High prices are being driven by thermal closures and outages compounded by soaring fuel prices for gas and coal.

- Interconnector constraints are also hampering NSW’s ability to import electricity from Victoria despite what is now an average price difference of $48/MWh.

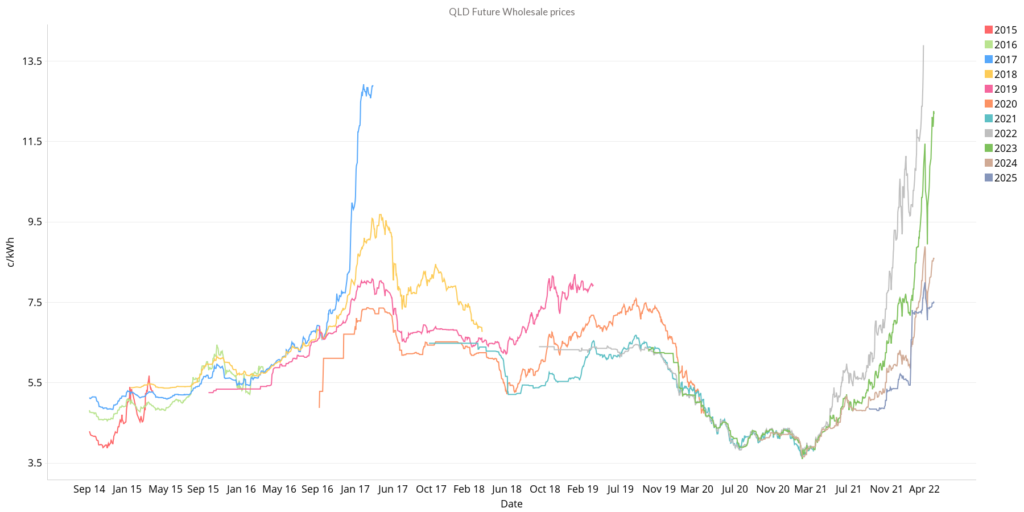

Queensland

- Queensland futures contracts went on a wild ride over April.

- After starting the month at record highs, prices plummeted during the first half of the month before sharply reversing to finish the month in some cases even higher.

- 2023 contracts are the most volatile, swinging 36% in two weeks to finish trading at $121/MWh.

- 2024 contracts are trading at $84/MWh, up over 100% on the corresponding period last year.

How did supply and demand affect price?

- Queensland’s volume-weighted average spot price has reached a whopping $236/MWh.

- Negative pricing intervals have all but dried up with only 9 for the month of April. Negative prices usually occur during the middle of the day when there is a surplus of solar generation.

- Black coal and gas supplied close to 80% of Queensland’s electricity during April, leaving the state heavily exposed to global fuel prices.

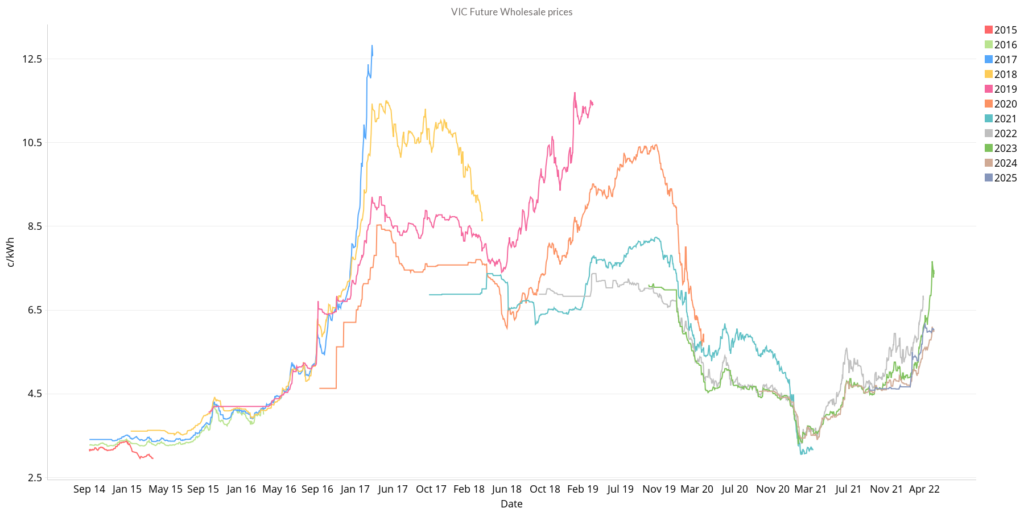

Victoria

- 2023 contracts started to move north in the April 2022 energy market, rising 30% to $76/MWh since the end of March.

- 2024 and 2025 contracts are still sitting around the $60/MWh mark which is looking like a bargain in the current climate despite being up around 65% at the same time last year.

How did supply and demand affect price?

- Victoria’s volume-weighted average spot price also soared this month to $150/MWh.

- Two of the state’s biggest coal-fired stations, Loy Yang A and Yallourn, suffered outages. Whilst at least one of the affected units at Yallourn is back in service the Loy Yang outage is predicted to persist until August.

- Renewables supplied 30% of Victoria’s demand for April with brown coal providing a further 60% shielding Victoria from the pain being endured by its northern neighbours. Brown coal is less affected by the global energy crisis as there is no export demand for it.

South Australia

- South Australia’s prices have been steadily rising for around 12 months.

- 2023 contracts are now at $85/MWh up from $37/MWh at the same time last year.

- 2024 contracts aren’t far behind at $76/MWh while 2025 is still trading at a substantial discount at $60/MWh.

How did supply and demand affect price?

- South Australia’s volume-weighted average price is at $166/MWh.

- Renewables supplied 67% of SA’s energy during April but the state relies heavily on gas to fill the gap.

- Gas supplied ~30% of demand in April and is often the marginal price setter in the state. This means that whenever gas is deployed to meet demand, that is the price paid for all the electricity supply during that interval – including the ‘cheap’ renewables.

- Gas prices have been at historic highs and are having a disproportionate effect on SA’s spot and futures prices.

The April 2022 energy market was dominated by price surges and extreme volatility. NSW and Queensland are the hardest hit and the most talked about in the headlines but prices in Victoria and South Australia have been steadily rising. NSW is hungry for imports which will keep pressure on Victorian and South Australian generators while pressure on fuel prices seems unlikely to ease in the near term. Reach out to our energy experts for advice on how to navigate the tough road ahead with the help of experienced and reliable energy brokers in Australia.

Disclaimer: The information in this communication is for general information purposes only. It is not intended as financial or investment advice and should not be interpreted or relied upon as such.