After writing about the accelerating pace of Australia’s renewable transition for some time now, February’s news still took us by surprise. Just as the futures price rises of the last few months looked to be finding a ceiling, Origin announced it would bring forward the closure of Australia’s biggest coal-fired power station Eraring to 2025. The market barely had time to swallow this sizable piece of news before activist investor Mike Cannon-Brookes and infrastructure giant Brookfield made an unsolicited play for Australia’s oldest energy company AGL. Although AGL’s board were quick to dismiss the bid, one thing is clear: Australia’s coal fleet is being squeezed from all directions. What is less clear is how swiftly, intelligently and cost-effectively these dispatchable assets are going to be replaced. If you would like to talk about options to increase energy price certainty, reach out to one of our experts today.

| INDICATIVE RATES | NSW | QLD | VIC | SA |

| PEAK | 10.01 c/kWh | 9.23 c/kWh | 6.06 c/kWh | 8.42 c/kWh |

| OFF-PEAK | 6.25 c/kWh | 5.6 c/kWh | 3.38 c/kWh | 5.36 c/kW |

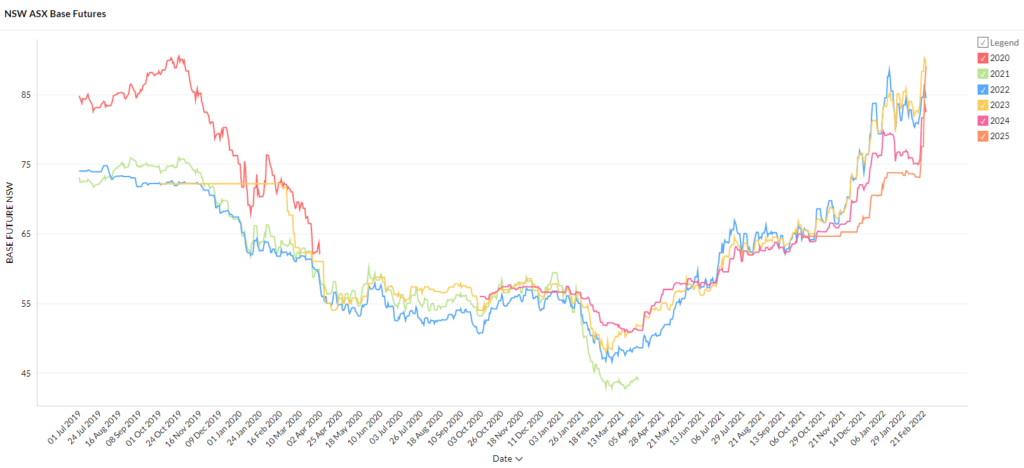

New South Wales

- Futures prices had been tracking flat until Origin’s bombshell Eraring announcement on Feb 17 and AGL’s unsolicited takeover bid a few days later.

- Futures contracts for all periods shot up from trading in a range of $73 – $82/MWh to $83 – $95/MWh by the end of the month.

- 2025 contracts saw the most dramatic spike rising 24% to $91/MWh.

How did supply and demand affect price?

- Eraring’s closure in 2025 dramatically shifts the energy landscape in NSW and reshapes the short term development that will be required to replace its despatchable 2,880 MW of power.

- Early analysis suggests that the current pipeline of solar development will be sufficient to replace Eraring’s daytime generation but there will be a need for accelerated wind and battery development to cover the all important evening ramp up. Ramping refers to generators that are able to ‘turn up’ the dial as required – a capability that needs to be replaced in a renewable future.

- Currently Eraring shoulders 42% of NSW’s evening ramping requirements. Origin plans to build a super battery at the site.

- Turning attention back to the present day, spot prices have been volatile and high. NSW saw spot prices from -$1,000/MWh to $15,100/MWh over February while the volume weighted average price (VWAP) jumped from $70/MWh in January to $86/MWh.

- The $15,100 spike on Feb 21 was due to a trip at one of Eraring’s units. A timely reminder of the behemoth’s impact on NSW supply. The spike only lasted 5 minutes with the high prices coaxing Tumut into increasing output.

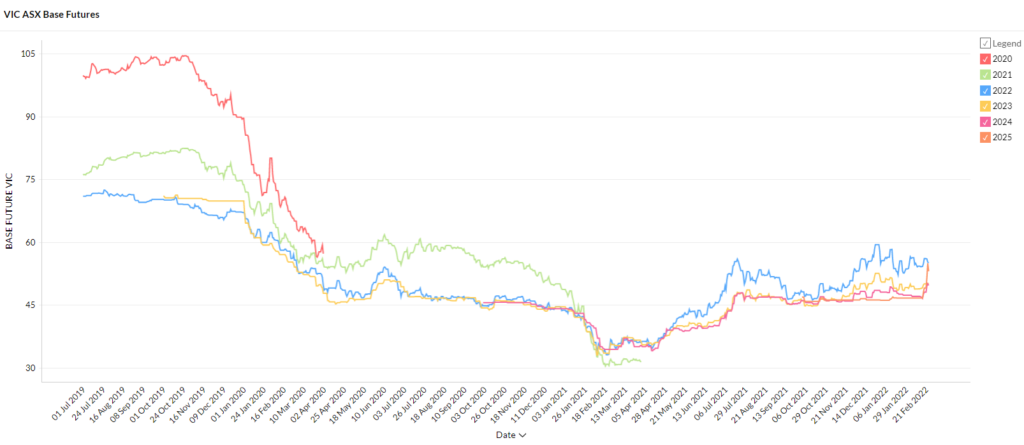

Victoria

- Victoria is still seeing futures contract prices between $50 and $60/MWh which is still toward the lower end of historical ranges. Prior to early 2020, contracts were frequently above $70/MWh and reaching above $100/MWh.

- All contract periods jumped on Eraring news with 2025 contracts the most significantly affected (up 16% to $54/MWh).

How did supply and demand affect price?

- Spot prices were low with a VWAP of $59/MWh and over 900 negative price intervals (falling to -$1000/MWh).

- Victoria stands to be affected by Eraring’s closure in 2025 due to potential impacts on interconnector flows with NSW.

- Victoria is also home to AGL thermal assets Loy Yang (coal) and Somerton (gas) power plants. The Cannon-Brookes/Brookefield bid for AGL was clear in its intent to bring forward the closure timeline of the energy company’s thermal assets. Although rejected by AGL’s board it is unlikely that the would-be acquirer’s have laid all their cards on the table just yet.

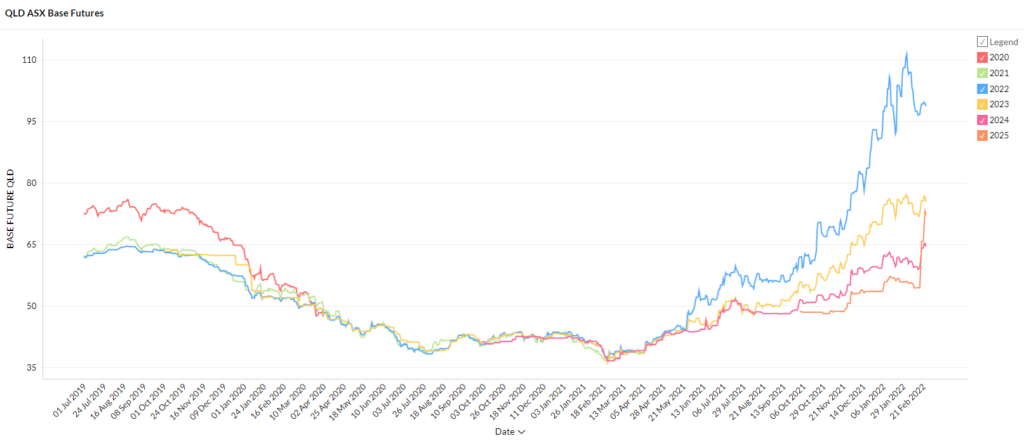

Queensland

- Queensland’s 2022 prices have remained persistently high, hovering around $100/MWh. For context, 2022 contracts were trading below $40/MWh this time last year.

- All contract periods reacted to varying degrees to the Eraring news with 2025 contracts unsurprisingly shooting up the most (up 33% to $72/MWh).

- 2023 and 2024 contracts are trading at $80/MWh and $66/MWh, respectively.

How did supply and demand affect price?

- February got off to a rough start with premier Palaszczuk issuing a request on February 1 for Queenslanders to reduce energy use amid heatwave conditions as Powerlink forecast record high demand of 10,032 MW (the record is 10,044 MW in 2019).

- Spot prices spiked above $10,000/MWh for around 2 hours as the RERT (Reliability and Emergency Reserve Trader) mechanism was dispatched to curb demand.

- High demand was exacerbated by supply issues with ~2GW of coal generation unavailable and wild weather causing network outages.

- Heat wave and high price conditions persisted through to February 2, contributing to a high average spot price of $185/MWh for February.

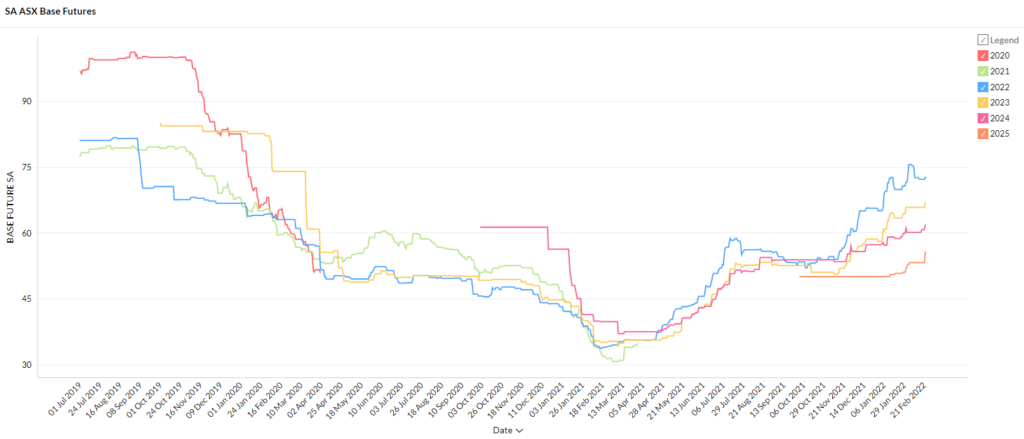

South Australia

- Futures contracts flatlined into February 2022 until the Eraring news caused modest jumps around February 17.

- 2022 contracts were the exception to this rule rising in early Feb before falling around the 11th and remaining unmoved by Origin’s big news.

- All contracts are well up on the lows seen this time last year with a clear trend toward prices falling with time.

How did supply and demand affect price?

- Spot prices reached $4,000/MWh on Feb 23 which appears to have been caused by a confluence of factors including interconnector constraint, low wind output and a sudden and brief drop in solar output.

- The new NSW-SA interconnector slated for completion in 2025 will help SA ride-out these conditions better in future and may explain the expectation of lower prices in 2025 seen in the futures markets.

February 2022 has been a tumultuous month in the Australian energy landscape with the renewable transition reaching an almost unthinkable pace. While our attention as always is on analysing energy trends so that we can deliver for our customers, we are mindful that this market activity has played out against a grim backdrop of catastrophic flooding at home and escalating unrest abroad. Our hearts are with our friends and customers in northern NSW and south-eastern QLD and with all the people of Ukraine.

Disclaimer: The information in this communication is for general information purposes only. It is not intended as financial or investment advice and should not be interpreted or relied upon as such.