Soft spot prices and rock bottom futures continued into the first half of May with mild weather, COVID-19 restrictions and plentiful supply all playing a part. AEMO released an analysis that confirms Australia has seen only moderate reductions in demand due to COVID-19 and NOT the 30% reductions anticipated based on Northern Hemisphere examples. With lockdown restrictions beginning to ease and a handful of minor outages, electricity prices started to bounce off record lows in mid to late May. Futures prices in all states are between $44 and $60/MWh and we are seeing businesses scramble to lock in long energy contracts.

Act now to secure record low prices.

Indicative retail prices*

| Indicative Rates | NSW | VIC | QLD | SA |

| Peak | 7.0c/kWh | 5.5c/kWh | 6.0c/kWh | 6.5c/kWh |

| Off-peak | 5.3c/kWh | 4.5c/kWh | 4.0c/kWh | 4.5c/kWh |

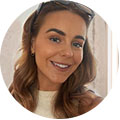

New South Wales

Key Points:

- NSW futures prices for all periods have been bouncing between $53 and $57/MWh since early April.

- The downward trend appears to have found a bottom at these prices and the bounce in late May can clearly be seen.

- Prices have not been below $60/MWh since 2016.

How did supply and demand affect price?

- Modelling by AEMO found COVID-19 demand reductions in NSW on weekdays of around 4-6% (400MW) across most of the day.

- The evening peak has only been marginally impacted (1-2%) and weekends are largely unaffected.

- Mild weather, strong renewable output and low gas prices contributed to low spot prices.

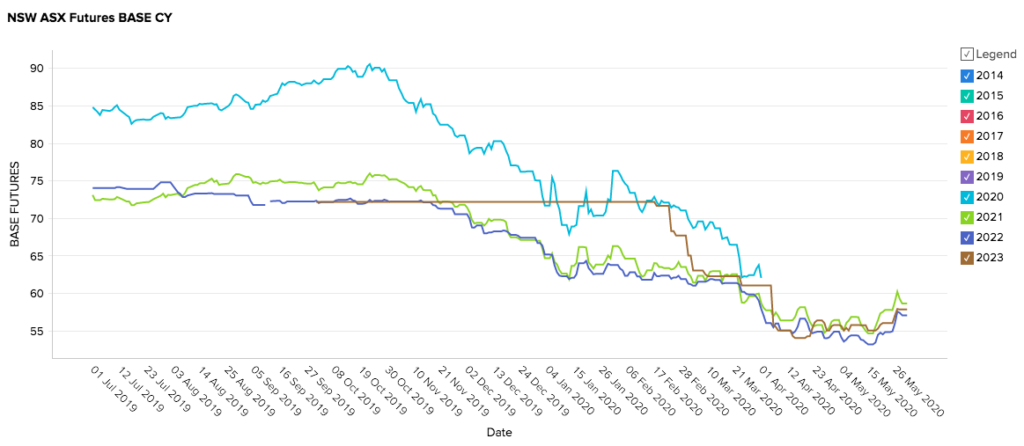

Victoria

Key Points:

- Prices for all periods have been between $45 and $58/MWh since the beginning of April.

- 2022 and 2023 prices are below $50/MWh having fallen from around $70/MWh since January.

- Prices have not been this low since 2016 but an upward trend is forming.

How did supply and demand affect price?

- Victoria has experienced some COVID-19 reductions in demand.

- Morning peaks have been reduced by around 8% (400MW) and shifted to a little later in the day while the midday trough fell around 5% on weekdays and 3% on weekends.

- Even with AEMO’s advanced modelling, it is difficult to separate the effects of rooftop solar proliferation from COVID-19 impacts on operational demand.

- Mild weather, low gas prices and strong renewable output contributed to soft spot prices.

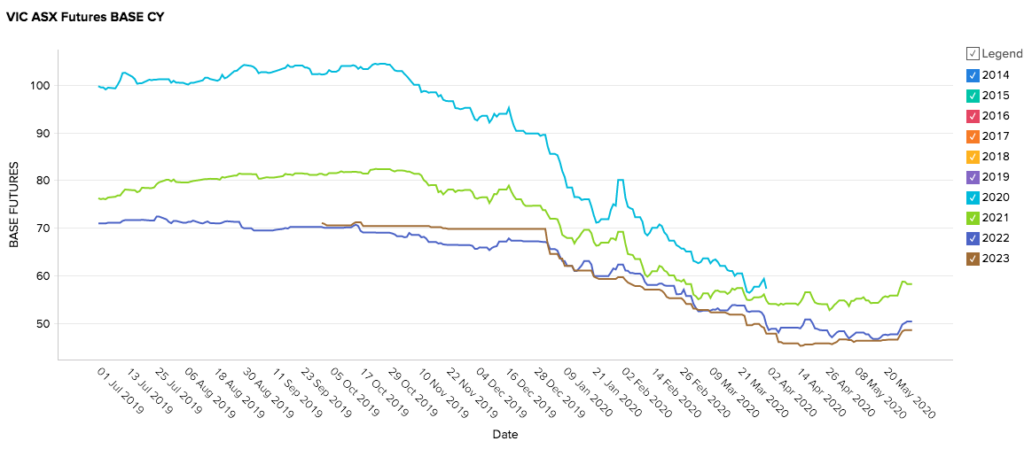

Queensland

Key Points:

- The downward price trend in Queensland continued throughout most of May hitting rockbottom prices of $42 – $43/MWh.

- Prices for all periods have been very tightly consolidated since late March and are currently between $44 and $46/MWh.

- It has been over 5 years since prices have been below $48/MWh.

How did supply and demand affect price?

- Wholesale spot prices went negative for 4 consecutive days (down to -$700) after the QNI connector came down in strong winds.

- The oversupply issue forced many solar farms to switch off to reduce exposure to negative prices.

- While Wivenhoe pumped hydro facility seized the opportunity and got paid to operate one of its pumping stations at close to capacity.

- Queensland demand has been affected by COVID-19 primarily on weekday mornings (8-9%) with smaller impacts on weekends.

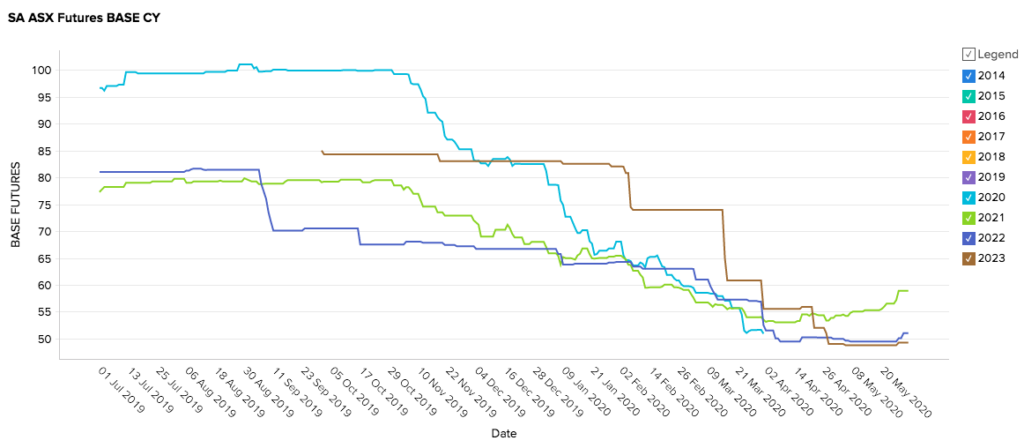

South Australia

Key Points:

- Futures prices have been between $48 and $58/MWh since early April.

- 2023 prices fell further in the last month from $55 – $48/MWh bringing the fall since late January to over 40%.

- There was a minor uptick for 2022 and 2023 toward the end of May.

- While 2021 is demonstrating stronger upward momentum after bottoming out around $53/MWh.

How did supply and demand affect price?

- South Australia has only seen modest demand reductions since the COVID-19 crisis to the point that AEMO is unable to conclusively attribute the drop to anyone cause.

- Spot prices continued to be low with negative prices a regular occurrence around midday thanks to solar generation.

- South Australia uses a large proportion of gas generation to support its renewable capacity and is therefore also benefiting from the current low gas prices.

In Summary

Electricity futures crashed from mid-March as the impact of COVID-19 on energy markets played out around the world. Thankfully Australia has largely charted its own course through the pandemic both in combating the virus and in the impacts we are seeing on our energy systems. We are seeing prices rise as lockdown restrictions ease and now is the time to lock in long term electricity contracts.

Act now to lock in low energy prices – contact one of our Energy Experts today!