Energy futures markets remain at rock-bottom prices, and we are continuing to secure ridiculously low contracts for our clients. “The deals we are securing are incredible. I haven’t seen anything like it in the past 5 years” – Energy Expert, Ewen Beard.

Some retailers are starting to offer rates out to December 2025, which has created an opportunity for large market electricity customers to lock in a long-term contract at low rates that we have not seen since 2016. August spot price volatility increased with record renewable output delivering negative prices, while outages in the thermal fleet sent prices skyrocketing just days later. Secure a low rate now!

Indicative retail prices*

| Indicative Rates | NSW | VIC | QLD | SA |

| Peak | 5.9c/kWh | 7.0c/kWh | 4.5c/kWh | 6.1c/kWh |

| Off-peak | 5.1c/kWh | 4.9c/kWh | 3.9c/kWh | 4.32c/kWh |

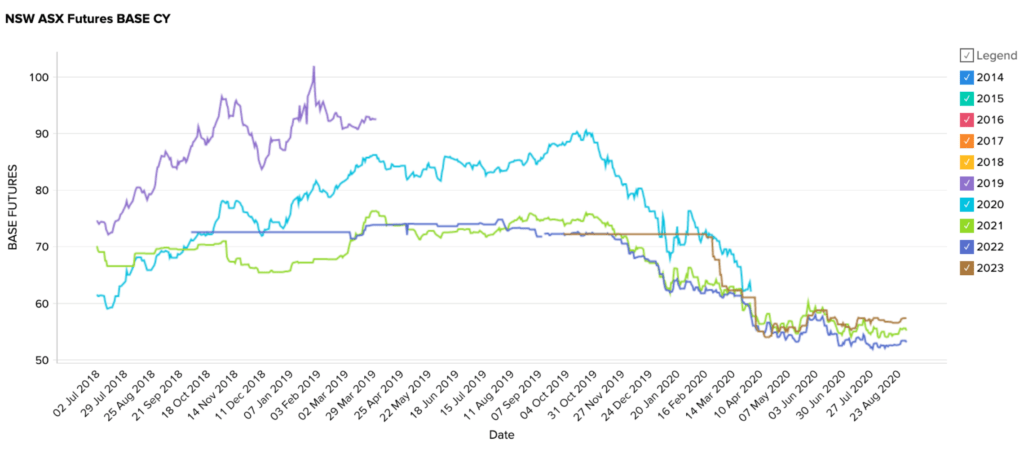

New South Wales

Key Points:

- Energy futures market prices are largely unchanged from last month sitting between $53 and $58/MWh.

- The sideways trend has persisted since March and the current prices represent excellent value compared to historic prices.

How did supply and demand affect price?

- There has been an increase in spot price volatility over the month with short spikes above $10,000/MWh on the 24th of August due to a cold snap and outages in the thermal fleet.

- The COVID crisis is likely to have caused delays in maintenance schedules and outages (both planned and unplanned) may increase in the near term.

- Sunny and windy conditions contributed to a new renewables record being set in August with 48.6% of total NEM demand being supplied by wind, solar and hydro for 30 minutes on the 20th.

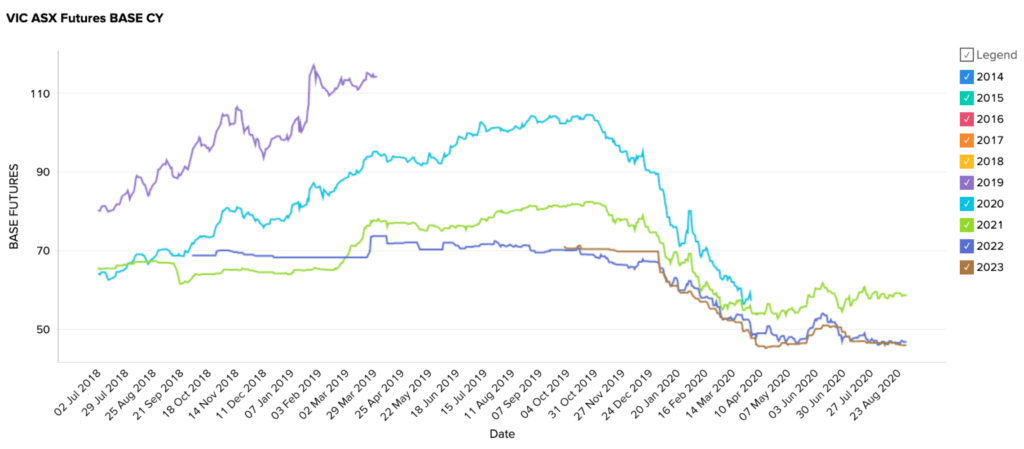

Victoria

Key Points:

- Prices are largely unchanged from last month.

- 2022 and 2023 contracts are still very low around $46-47/MWh presenting excellent value considering the uncertainties facing the grid between now and then.

How did supply and demand affect price?

- Operational demand fell to 2991 MW at 1 pm on the 29th, possibly the lowest daytime demand since the inception of the NEM.

- This is due to the proliferation of rooftop solar and was accompanied by negative prices.

- Although renewables bring down spot prices they also increase volatility and this demand slump highlights that issues for grid operators dealing with low operational demand may appear sooner than previously thought.

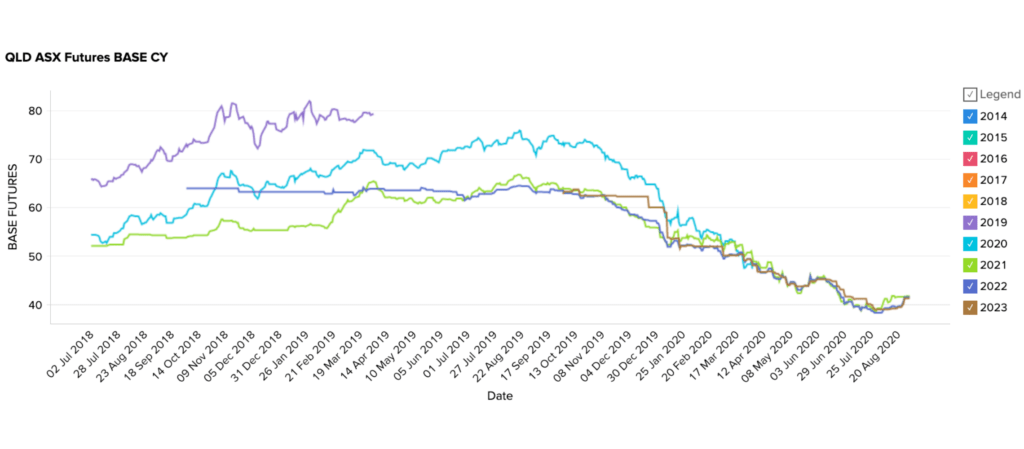

Queensland

Key Points:

- A slight uptick in prices can be seen across all future contract years.

- Prices for all years are remarkably close, varying by only a few cents and trading around $41.50/MWh.

How did supply and demand affect price?

- On August 23rd Queensland experienced its lowest operational demand since 2004 due to its huge and growing solar capacity.

- This was followed just a day later with a spot price spike to $1500/MWh as the thermal fleet had trouble meeting a cold-induced demand spike.

- These events demonstrate the volatility that is likely to come as the transition to renewables progresses and highlight the benefit of locking-in a low and stable contract now.

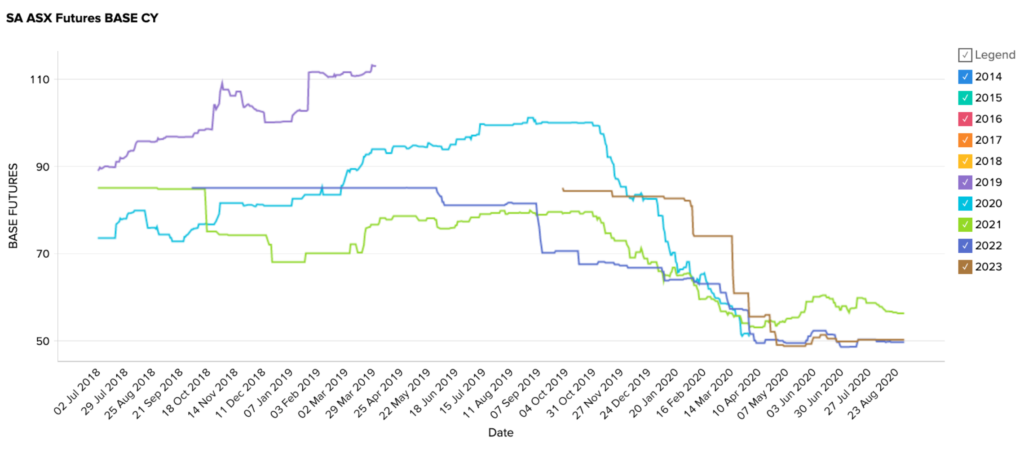

South Australia

Key Points:

- Futures prices are remaining in a sideways trend with the latter years cheaper than 2021.

- 2021 is trading at $56/MWh while 2022 and 2023 are at $49-50/MWh bringing prices in line with Victoria and NSW.

How did supply and demand affect price?

- A low-pressure system over SA has seen strong wind output with 100% of SA demand being met by the wind on several occasions.

- Solar output has also been strong with one-third of SA’s demand being met by solar on the record-breaking 20th of August.

- Low gas prices linked to COVID have also kept SA’s spot prices low.

In Summary

Flat energy futures prices over August concealed what was a fairly eventful month. Broken records for renewable output and low operational demand are cause for optimism. Still, the transition is happening quickly, and we do not have systems in place to manage large quantities of variable supply.

The price spikes of August 24th demonstrated the effects of a few outages in the thermal fleet, and these can be expected to continue. Current energy futures market prices are at rock-bottom and locking-in a lengthy contract is a great way to shield your business from the volatility of the renewable transition.

Act now to lock in low energy prices – contact one of our Energy Experts today!

Disclaimer: The information in this communication is for general information purposes only. It is not intended as financial or investment advice and should not be interpreted or relied upon as such.