Australia’s Eastern states are facing the brunt of the country’s energy crisis as gas and electricity bills surge to record highs.

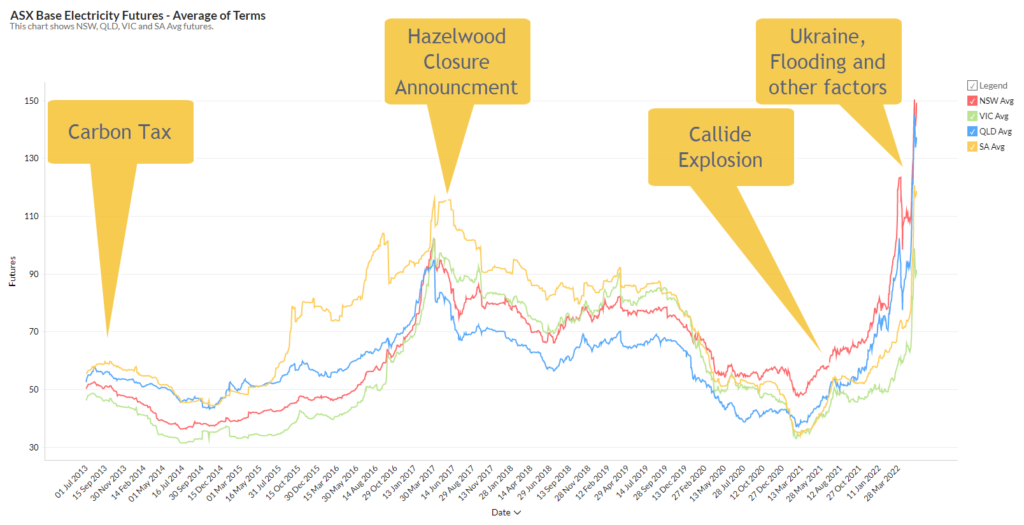

The last time Australia experienced a sharp uptick in energy prices was 2017 when Victoria’s coal-fired Hazelwood plant shut down abruptly taking 1,600 MW of power out of the market.

But the increase in prices five years ago pales in comparison to what is being experienced at present in 2022.

A confluence of events has precipitated a crisis that shows no sign of abating until well into the next financial year.

The war in Ukraine and the huge demand for coal and gas

The largest overriding factor influencing electricity prices all over the world is the war in Ukraine. The world railed against the invasion by ditching Russian coal and gas, leading to a huge upsurge in demand for fossil fuels from other sources.

This has in turn led to record international prices for coal and gas. Australia is currently in a situation where fossil fuels are being sold onto the international market and energy generators are then forced into buying them back at very inflated prices.

Some Australian exporters have received prices four or more times higher than normal.

The price of Australian black coal, exported from the Port of Newcastle, has quadrupled since the start of the year, exceeding AU$500 per tonne.

Oil prices have almost doubled since January. Asian markets peg gas prices to oil, which has in turn sent gas prices soaring.

Wholesale prices in New South Wales and Queensland – both of which are heavily reliant on black coal – have gone up five-fold over the same period last year.

The Australian Energy Regulator was due to announce its Default Market Offer (DMO) before the Federal election but delayed until May 26 to avoid politicisation of the issue.

Generation companies put pressure on the AER to up the DMOs, stating that they would simply not be able to compete.

In fact, several smaller retailers have already gone out of business and others are urging customers to seek other offers while others have closed to new customers until they release their new pricing plans in the 2023 Financial year.

The AER advised that the default market offer for Small Business (SME) electricity customers in New South Wales would increase by between 10% and 19.7%, while SME customers in south-east Queensland would see benchmark electricity prices rise by 12.8%.

Modeling shows that the average New South Wales consumer will pay between $690 to $1,146 more in annual electricity costs, while the increase for south-east Queensland and South Australian consumers will be $705 and $459, respectively.

Victoria fared somewhat better and the default offer pointed to a 5% annual increase in electricity prices.

Summary of Default Offer Increases from July 1 2022

| State | Network | Default Offers – Avg increase % (SME Customers) | Default Offers – Avg increase $ (SME Customers) |

| NSW | Ausgrid | 10% | $690 |

| Endeavour | 19.7% | $1,130 | |

| Essential | 14.7% | $1,146 | |

| QLD (South East) | Energex (SE QLD) | 12.8% | $705 |

| SA | SAPN | 5.7% | $459 |

| VIC | Ausnet | 10.41% | $722 |

| CitiPower | 2.67% | $126 | |

| Jemena | 1.60% | $85 | |

| Powercor | 4.47% | $222 | |

| United Energy | 4.10% | $197 |

Coal-fired generators are failing and flooding has reduced the amount of coal in the market

In addition to coal streaming out of Australia in lucrative exports, La Nina induced flooding of coal shafts has led to less coal than usual being available on the market.

Origin’s coal-fired 2,880 MW Eraring plant is Australia’s largest. But it is struggling to procure coal. When it does manage, it pays hugely inflated prices and the additional cost of shipping it to the site by rail.

Flooding at mines around the country including Yallourn and the Hunter Valley has led mining companies to excavate flood storage, but this process will take time.

In the meantime, many mines are experiencing significant cutbacks in production due to flooding.

Total coal sales are down from 200Mt to about 170Mt. International sales have dropped and producers have prioritised international markets, leading to domestic coal generators being squeezed.

As the available coal supply fell, coal generation also dropped sharply and gas stepped in to fill the gap in supply.

This pushed up the demand for gas generation by about an annualised 60-70 petajoules or a 15% increase in Australian gas demand (excluding Western Australia).

A compounding factor to the situation is the number of outages in Australia’s ageing coal-fired power fleet with more than 25 per cent being offline for much of the year.

Units that are currently partially offline include Callide C, Loy Yang A, Yallourn, and a number of interconnectors.

These outages fuelled the demand for gas, which continued to drive prices even higher.

Australia is running low on gas

Gas supplies in Australia are running low. It may be easy to assume that this is because there is not enough output.

But in reality, Australia does not have a gas generation problem; it has a gas exportation problem. While LNG gas extraction firms are selling huge amounts onto the international market, there is a shortage on the domestic market to replace coal outages and shortfalls due to lack of fuel.

On Wednesday, June 1, the Australian Energy Market Operator triggered the Gas Reserve Mechanism, for the first time since its inception during the Turnbull Government in 2017.

The mechanism obliges Queensland’s LNG producers Santos, Origin and global player Shell to make more gas available as a result of the shortfall in the NEM.

Santos’s GLNG project, Origin Energy’s Australia Pacific LNG venture and Shell’s QCLNG project diverted gas into the domestic market.

They are sending about 100 terajoules a day South but the pipeline is at maximum capacity, adding to further price pressure. It remains uncertain for how long the diversion will continue.

The weather has turned very cold

As if the above reasons were not enough, a very cold snap has gripped the South East of Australia, bringing forward the winter surge in demand for gas heating.

It is easy to underestimate the demand for heating and a lack of progress on electrification tied to renewable energy generation just adds one more ingredient to fuel Australia’s Energy Crisis.

Corrective action

AEMO has imposed a wholesale price cap of $40 per gigajoule ahead of forecasts that the spot price in Victoria was set to climb to $382.

The “shadow price,” were it not for the cap, would have hit $800 on Tuesday, June 2.

$40 per gigajoule is financially crippling for large industrial consumers, and the country simply cannot magically source gas that does not exist.

Incoming Federal Energy and Climate Change Minister Chris Bowen have convened meetings with AEMO and state governments to plot the way out of Australia’s Energy Crisis.

Managing usage and costs

Now is the time for businesses to be careful. Especially those that are coming to the end of their existing energy and gas contracts.

Leading Edge Energy can help you time when you go to market on your next energy contract, choose the right contract term, and take steps to improve and manage energy efficiency. All the above can have a massive impact on your company’s energy costs.

Some of the key steps businesses should be considering include:

- Be an “informed” buyer. Leading Edge Energy will not bill you if we secure your new or renegotiated contract. What you are quoted is what you pay – no hidden extras.

- We carefully review terms and conditions within current and new contracts.

- We monitor and inform you of your contract expiry dates. Default rates accrued when you go past contract dates can be significantly higher.

- Focus on load forecasting when negotiating new contracts – this can align contracts with the actual predicted volumes and secure contract lengths that meet individual business needs.

- Given the current volatility, customers with 6 – 12 months left on their current energy contract should act now. Waiting longer could result in higher prices. You can secure a new contract even if you are still locked in a deal.

- Energy efficiency projects should be given a high priority as these will deliver real solutions to protect your business from market volatility.

We can help your business get this right, giving you a cost advantage over other local competitors who don’t have an energy strategy.

The optimal procurement strategy and negotiating the right contract terms take time to implement.

Leading Edge Energy offers a range of tailored services that can help your business assess, improve and manage onsite levels of energy efficiency through the use of innovative energy efficiency and energy management initiatives.

With the right advice, your business can gain a competitive advantage by proactively adapting to the new realities of Australia’s energy market.

Our Energy Management Consultants have a proven track record in helping Australian businesses manage their energy costs.

Reach out to us by filling out this form or sending us an email at info@leadingedgeenergy.com.au.

If you would prefer a chat over the phone, you can call us on 1300-852-770 for an obligation-free session with one of our Energy Management Consultants.