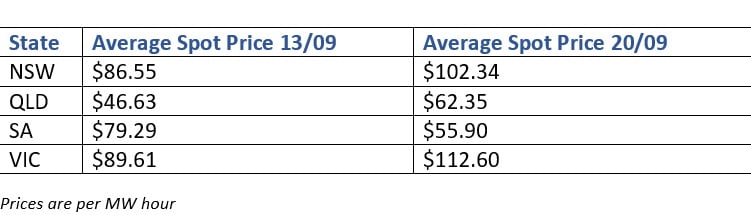

The failure of the 500-Megawatt Basslink cable, AGL’s Loy Yang A and the Mortlake gas power station in Victoria has sparked more volatility in the electricity spot price market, and placed upward pressure on the futures market prices as the reliability of electricity supply to the NEM is brought into question.

Increased wholesale futures prices then flow through to commercial and industrial market (C&I) rates being offered by electricity retailers to large market (C&I market) customers.

How is reliability affecting the electricity spot price market and futures prices?

The Basslink cable connects Tasmania to Victoria and the current fault means that Tasmania cannot transfer energy to and from the mainland.

Investigators say the fault, which occurred above ground Victoria side, could be fixed by mid-October, but there are concerns that repairs will drag on into the summer.

The same holds true for Loy Yang A (2,210 MW), with the Australian Energy Market Operator (AEMO) forecasting a 30 percent chance of the outage extending over summer and a 60 percent chance for the same happening with Mortlake (566 MW).

The fact that supply has been taken out of the market has pushed spot prices up, meanwhile, time-frames for repairs are uncertain which is in turn pushing wholesale futures prices up. As a result, retailer C&I market offers are also up.

Given the time of year (spring and summer) there is another factor at play: When the weather gets hot, demand for electricity increases due to the increased reliance on air conditioning units, refrigeration, etc.

This makes a worried market even more spooked as poor reliability and restricted supply are compounded due to forecast increased demand.

Contract prices across the summer periods have already increased in Victoria as the market aims to price in the risk of Basslink and Loy Yang A not being returned to service on time.

Meanwhile, AEMO has highlighted the need for all available resources, including Basslink, to be available for the upcoming period of peak demand. What is even more worrying, is that AEMO’s warning was issued before the Basslink fault.

How does understanding the energy market help electricity consumers like you?

Getting a good grasp of the National Energy Market and futures prices can help you make informed decisions about your energy contract. That said, keeping track of the developments in the NEM can be complex and time-consuming when business owners like you would prefer to spend time on growing your company. Fortunately, our Energy Experts at Leading Edge Energy are always keyed into the NEM and have the expertise to guide you to achieving your energy efficiency goals.

Want to get started? You can fill in our form, call us at 1300 852 770, or e-mail us at hello@leadingedgeenergy.com.au.

Or if you want to learn more first, check out our case studies pages, read our articles on how to save on your business’ lighting, why relationship-building and energy efficiency are key to business recovery, and why you need to work with an energy expert.