Persistent ultra-low wholesale prices are starting to take a toll on coal-fired generators. The February 2021 electricity market saw energy giants AGL and Origin report first-half earnings, and it wasn’t pretty. AGL posted a $2.3 billion loss and hinted at a demerger, while Origin saw earnings fall 98%.

Origin CEO Frank Calabria told shareholders, “these wholesale prices are unsustainable. There will be a supply response, it’s just whether it will be planned or unplanned”. The question remains whether the renewable transition will be advanced enough to deal with early closures or unplanned outages as thermal owners pull back on maintenance and investment costs.

Protect yourself from price volatility!

| Retail Rates* | NSW | VIC | QLD | SA |

| Peak | 6.20c/kWh | 5.21c/kWh | 4.84c/kWh | 4.68 c/kWh |

| Off-Peak | 4.12c/kWh | 2.87c/kWh | 3.43c/kWh | 3.34c/kWh |

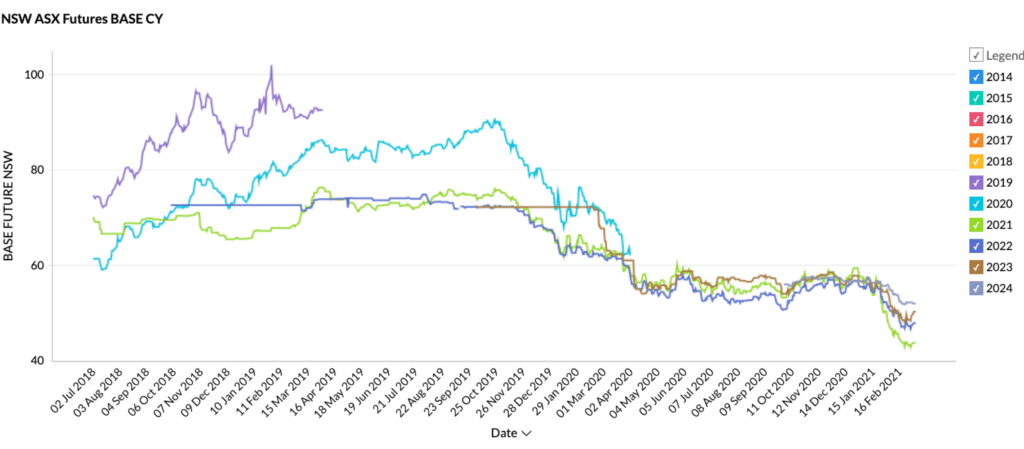

New South Wales

- Futures prices fell steeply over February to fresh lows

- There is increased variation between the years with 2024 trading at a 23% premium to 2021

- 2021 is trading at ~$42/MWh and 2024 at ~$52/MWh with 2022 and 2023 in the midrange

How did supply and demand affect price?

- The flood of cheap renewables has kept spot prices very stable and low at around $35/MWh

- Supply from thermal generators is beginning to tighten up in response to the low prices

- Origin has voluntarily halted output of one unit at Eraring on the central coast – this is very unusual in the summer peak

- Several of AGL’s units at Bayswater and Liddell are operating at below 50% capacity. It is unknown whether this is in response to prices or to reduce strain on the aging plant.

- AGL told shareholders they planned to defer major planned outages to manage costs, in other words, they are cutting back on maintenance

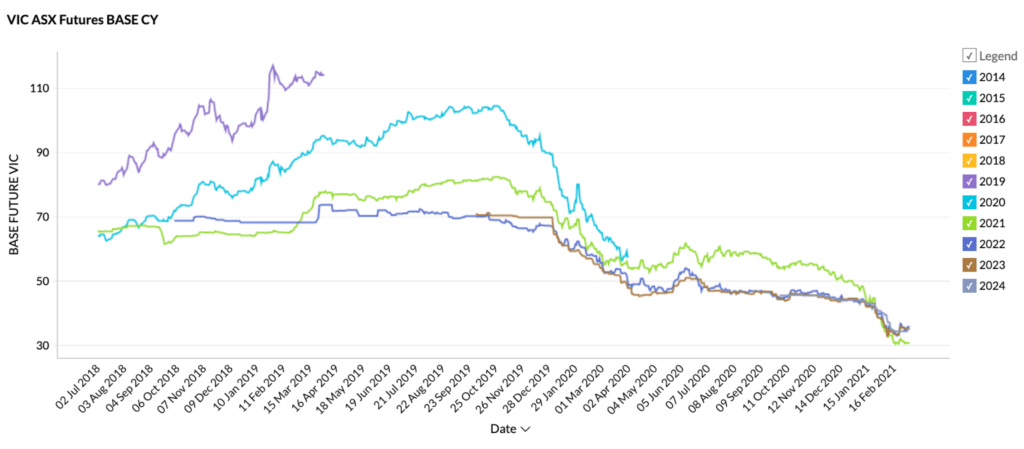

Victoria

- Futures prices plunged to between $30 and $34/MWh in mid-February before bouncing slightly toward the end of the month

- The market is beginning to price latter years higher than 2021, a reversal of the trend seen for the last 2 years where prices were expected to fall with time

How did supply and demand affect price?

- Spot prices were very low with frequent negative prices during the daylight hours a testament to the role increased solar supply is playing in driving prices down.

- Energy Australia’s Yallourn W power plant was identified by a research think tank as likely to begin losing money if wholesale prices dip any further

- Loy Yang A appears to be operating at reduced output

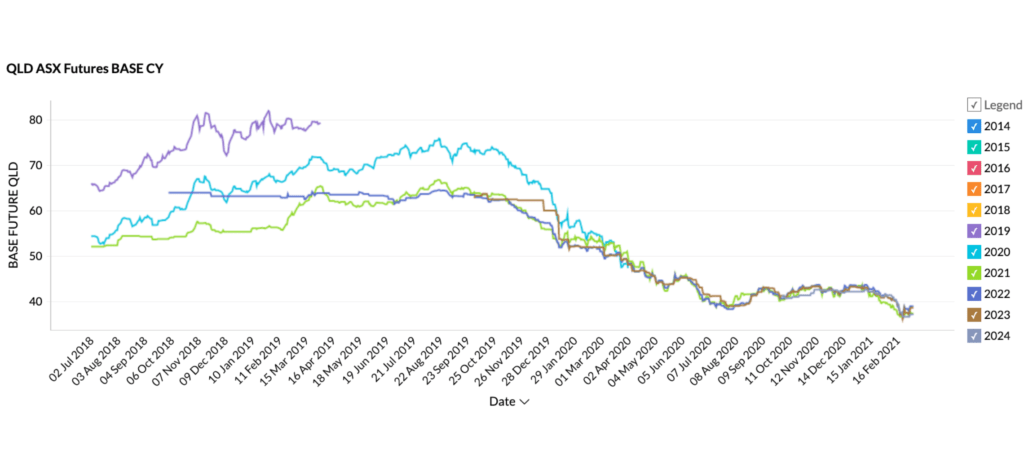

Queensland

- Queensland futures fell mid-month with 2023 prices briefly breaching the $36/MWh mark before bouncing back toward the end of the month

- Futures are trading between $36 and $38/MWh

How did supply and demand affect price?

- Spot prices were very stable and low around $35/MWh

- Prices spiked briefly to $2360 in the evening as high temperatures pushed QLD’s demand to the highest for this summer – 9,476MW on February 22nd

- Queensland government-owned fossil fuel generators saw more than $1 billion value wiped off due to falling wholesale prices

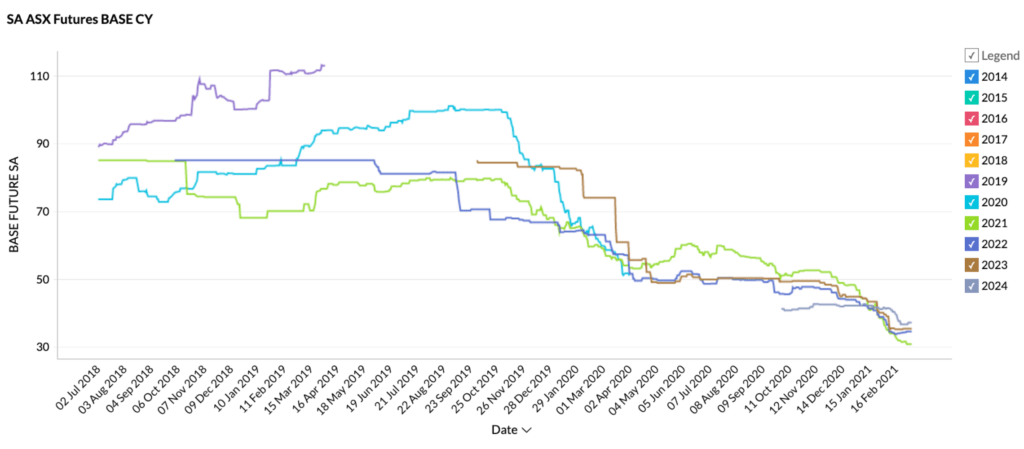

South Australia

- 2021 prices fell 14% over February from $36 to $30.75/MWh

- 2022, 2023 and 2024 also fell toward the beginning of the month before leveling off

- As in Victoria there has been a shift toward higher pricing in the latter years compared with 2021 suggesting the market believes current prices are unsustainable

How did supply and demand affect price?

- Spot prices were volatile ranging from as low as -$520 to $252/MWh

- South Australia continued to test low operational demand limits hitting 276 MW in the middle of the day in mid-February

- Low operational demand in the middle of the day is attributed to rooftop solar that is consumed on-premises

All summer, we have watched as renewable output surged and wholesale prices tumbled. This month we are starting to see the economic reality hit home as Australia’s largest energy players grapple with the new normal. As Frank Calabria told investors, there will be a supply response, how it will play out, nobody knows.

Our energy experts are always available to help your business manage risk and volatility in the energy markets. Get ahead of looming rate changes.

Disclaimer: The information in this communication is for general information purposes only. It is not intended as financial or investment advice and should not be interpreted or relied upon as such.