The global natural gas crunch has created an energy crisis of epic proportions in the northern hemisphere, causing electricity retailers to go bust and prices to go through the roof and highlighting how businesses can reduce energy price risk by hedging.

The gas shortage is the principal driver in this situation, but it has been compounded by bottlenecks in getting renewable energy into the grid.

North Europe, for example, has experienced some of the slowest wind speeds in 20 years, causing wind turbines to sit idle.

The problem is so severe that governments are preparing to step in and intervene in the volatile electricity markets to make sure that people can afford to heat their homes over winter and keep factories running.

Why is there a gas shortage?

Europe, the United States, and Asia are emerging from the COVID pandemic, their economies are opening up again, and demand for electricity is ramping up.

Late summer is the time when Europe restocks its gas inventories in time for the cold winter. 2021 saw gas storage sites fall to their lowest levels in a decade following a cold winter in 2020.

Russia, which supplies Europe with much of its gas, limited exports because it was restocking its own inventories.

Norwegian gas flows, which also make up a substantial part of supplies, were also low due to maintenance at gas fields and processing stations.

China is also stockpiling natural gas and competes with Europe for imports.

Another factor that is impacting the situation is that there has been less investment in new coal and gas production due to concerns about climate change.

Prices have recently (7 October 2021) eased somewhat after Russia offered to increase exports to Europe.

What do gas prices and hedging have to do with electricity prices?

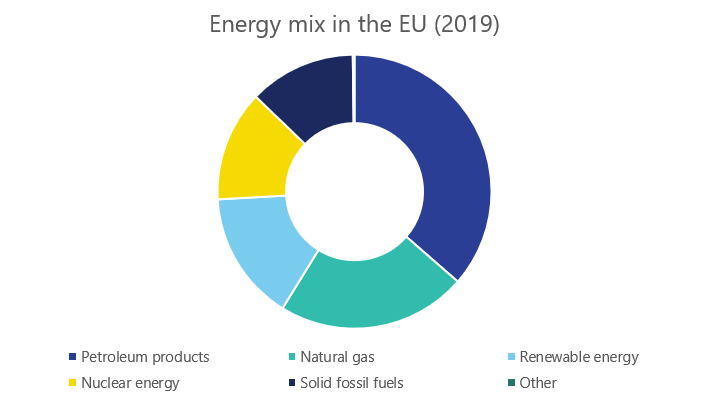

In 2019 (before Brexit), the energy mix in the EU was made up of five different sources: Petroleum products (including crude oil) (36 %), natural gas (22 %), renewable energy (15 %), nuclear energy (13%) and solid fossil fuels (13%).

Europe is leading the charge to net zero by 2050 and has therefore shifted its focus towards renewable energy sources.

Storing renewable energy generation is not an easy task and Europe’s large-scale battery storage industry is still in its infancy. This situation dictates that any big swings in fuel costs translate into price volatility.

Almost a quarter of the bloc’s energy was produced by burning natural gas and the supply crunch has led to an upward explosion of electricity prices.

Australia is no stranger to such situations. In May 2021, over 800 MW of electricity dropped out of the grid after an explosion at Callide C in Queensland.

The gap needed to be plugged and gas-fired generators filled it, driving gas and electricity prices up as a result.

So why is the UK close to running out of power?

The UK has limited electricity interconnector cables linking it to mainland Europe and is also reeling from the effects of leaving the European Union.

Coal generation makes up 1.6 percent of energy generation, but this has increased to 3 percent during the crisis.

If any outages to its aging fleet occur at a time when there is little wind or solar power available, the UK could come very close to running out of electricity.

Retailers that have no hedging agreements are going bust

An unprecedented rise in wholesale gas costs means many electricity retailers have promised energy to customers for less money than it now costs.

Traditionally, energy retailers have turned to hedging agreements to protect themselves against such spikes.

Hedging is essentially a form of insurance. It is a contract to fix the price of a commodity and protect against any adverse movements.

With commodities like gas, producers are trying to protect against downward movements in price while buyers are trying to limit the peaks.

Those retailers that did not have a hedging agreement are suddenly faced with selling energy for more than it costs to purchase it.

Others “under hedged” by taking on more customers without having an agreement in place to cover them. This would be like renovating your house or building an extension without updating your insurance policy to reflect the new value.

Purchasing futures energy contracts can protect your business against price spikes

Another way to protect your business from drastic energy price spikes is to forward buy your electricity contract with a retailer that will hedge it for you.

The wholesale market is a double-edged sword. Right before the COVID-19 pandemic, Australian electricity prices were at record highs, but they then dropped to historic lows.

They are picking up again as demand increases against tight supply. Prices for coal and gas have gone up fourfold since the end of 2020.

This means that businesses that were advised to forward buy their energy contracts when prices were at rock bottom made a double win by securing cheap electricity and protecting against any price shocks in the future.

A common misconception that businesses have is that it is not possible to forward buy electricity if they are still under contract.

This is not the case. Leading Edge Energy recently helped Dolphin Products make a 28 percent saving per annum by forward buying on the wholesale markets.

Is your business protected against natural gas shortages and price spikes?

Electricity and natural gas prices in Australia are a risk to your business if not proactively managed. Australia is linked to global coal and gas markets by exports.

The good news is that you don’t need to be an energy expert to stay ahead of the market to shield your business from energy price uncertainty.

You can make use of our free-to-use analysis tools to understand more about the National Energy market.

We’re here to help. Chat with us today about how we can help you manage energy price risk and save money for your business.

Drop us an email at info@leadingedgeenergy.com.au or call us at 1300-852-770 for an obligation-free consultation and let’s talk about how you can protect your business by forward buying gas and electricity on the wholesale market.

We source, analyse, compare and rank commercial, industrial and multisite energy quotes. Obligation Free.

Chat with one of our experienced consultants today and get the insights your business needs to help manage the risks associated with volatile electricity and natural gas markets. Our energy procurement service is obligation-free and provides a time-saving way of securing lower energy rates from our panel of energy retailers.