It sounds too good to be true and it is unthinkable in Australia, but businesses in Germany experienced negative energy prices over the Christmas weekend. This means that they were actually paid to use electricity.

The unexpected Christmas present was a result of a combination of factors: low electricity demand, unseasonably warm weather, and strong winds which provided an oversupply of power on EPEX Spot, a European power trading exchange.

Another factor that lent to the oversupply was that Germany has invested a whopping $260 million on renewable energy sources over the past two decades.

It has to be said that negative energy prices are not experienced routinely, but they are not rare. Throughout 2017, Germany experienced negative energy prices more than 100 times, according to EPEX Spot.

What causes negative energy prices?

On Christmas Eve, large-scale consumers were paid more than €50 (about $77) per megawatt-hour at wholesale value, to use power. To put this into perspective, the average cost of 1 MWh of power in Australia is about $120.

Put simply, electricity prices go “negative” when the supply of power outstrips demand for it. Germany’s use of wind power is one of the biggest variables in this equation and on average, giant wind turbines produce about 12% of the power needed in the country.

But on exceptionally windy days, wind turbines can generate much more electricity than usual without tripping the grid. For example, in the summer of 2016-2017, South Australia experienced a statewide blackout when high winds caused the grid to fail when over-cautious safety thresholds caused substations to shut down.

Another aspect that influences negative prices in some parts of Europe is that traditional sources of electricity, including coal and nuclear power, are cumbersome and cannot dial back generation quickly enough to stop the price plunge. Because of the glut of supply, prices then go negative on the electricity trading markets.

Where are the negative electricity prices found?

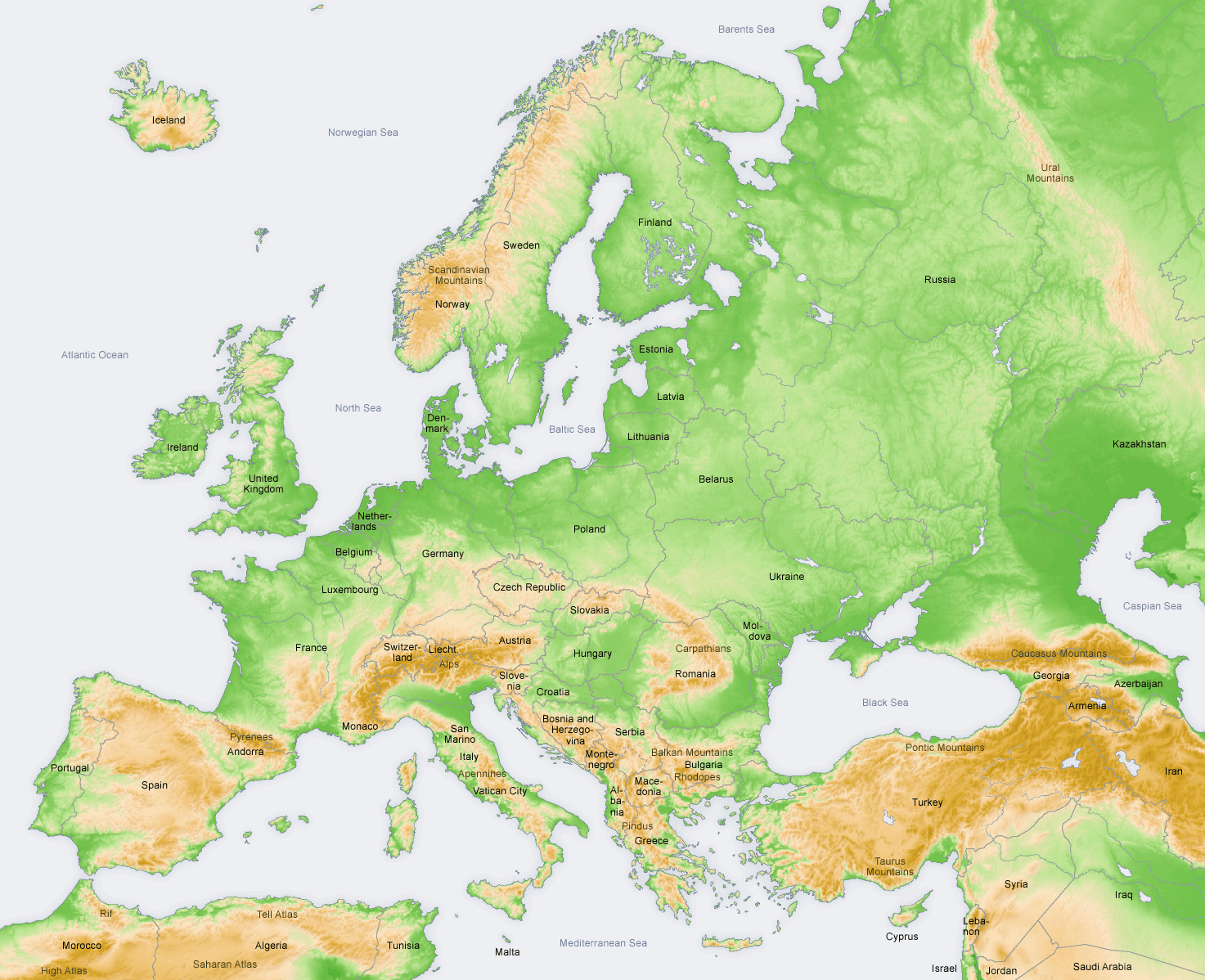

Aside from Germany, a number of European countries have also gone through periods of negative power prices, counting among them Belgium, Britain, France, the Netherlands, and Switzerland. A common denominator shared by these countries is that they all have a good energy mix that includes coal, pumped hydroelectric, nuclear, solar, and wind power. That said, in terms of experiencing negative energy prices, Germany tends to have longer and deeper occurrences than the other countries.

Currently, roughly 27 percent of Germany’s electricity is from renewables; the government’s goal is to get it to at least 80 percent by 2050. As early as now, however, renewable energy’s presence in the country is already considerable. In fact, on July 25, 2015, it was very windy in the north and sunny in the south and for a few hours, renewables yielded about three-quarters of Germany’s electricity.

During some occasions of oversupply, Germany has even been able to divert its surplus power toward its neighbours, thereby helping balance the market.

Meanwhile, Australia lags behind with 17%, although this percentage is expected to rise to 20% by 2020 and the Federal Government’s National Energy Guarantee claims that this will increase further once implemented in 2020.

31 hours of negative energy prices

Recently, during the last weekend of October, electricity prices stayed below zero for as long as 31 hours. The prices went as low as –€83 or -$130 per megawatt-hour.

Put simply, any business that was flexible enough to operate during that time was paid the above-mentioned amount as an incentive.

What makes the electricity supply so unsteady?

One big shortcoming that accompanies wind and solar power is that their production is dependent on weather conditions, not on actual demand.

Unfortunately, while Europe is at the forefront of renewable energy generation, it has not yet fully embraced battery technology Because battery storage is not advanced enough to store the excess energy generated in Europe, setting negative energy prices has become the easiest way for power generators to keep things going without having to shed loads and incur expensive restart costs.

On the other hand, Australia, South Australia in particular, is emerging as a world leader in this regard with its Tesla battery, but it is early days yet.

Can this be avoided?

The only way to avoid negative energy prices is by making sure that all energy generated is consumed. The same holds true for households. When there’s a surplus of electricity, businesses and households are encouraged to boost their energy-hungry activities.

German energy producers are also looking to employ weather experts to gain access to detailed forecasts, which in turn allows them to forecast operations and shut down some turbines when the winds are particularly strong.

Another way to take advantage of the situation is for pumped-hydro plants to use the negative power prices to pump water into reservoirs for generation when demand is high.

The topic of negative energy prices is just one of the many we cover in Leading Edge Energy’s blog and news sections. If you want to learn more about energy market developments, emerging technologies in electricity generation, or read tips on how to pick out energy-efficient lighting for your business site, this is your best bet.

Or, if you want to learn how Leading Edge Energy can help you take control of your energy consumption and costs, give our experts a call at 1300 852 770 or drop us a line at info@leadingedgeenergy.com.au.