Australia is feeling the pinch of the global energy crisis with soaring fuel prices sending wholesale electricity prices skyrocketing. We have never seen futures contracts move so fast with the May 2022 energy market’s gains dwarfing the past 5 years of market volatility. Queensland and NSW are the hardest hit due to their dependence on black coal and gas but South Australia and Victoria are not immune. Both states saw prices spike more than 70% as industry insiders described gas prices as ‘apocalyptic’ and AEMO was forced to step in with price caps. As we approach the end of the financial year and with so much turmoil in the marketplace now is the time to bring in the experts

Our online interactive tools can help you gain insights into market dynamics and our energy experts are available to help you translate those insights into an actionable plan for your business.

| INDICATIVE RATES | NSW (c/kWh) | QLD (c/kWh) | VIC (c/kWh) | SA (c/kWh) |

| PEAK | 30.00 | 30.00 | 25.00 | 25.00 |

| OFF-PEAK | 20.00 | 20.00 | 15.00 | 15.00 |

New South Wales

- 2023 contracts soared 57% from $125 to $196/MWh over May and reached an unheard of peak of $209/MWh. Prices are now 60% higher than any time in the last 9 years.

- 2023 contracts jumped 8% on the day after the Labor win.

- 2024 contracts also rose steeply to $130/MWh, a 30% increase over May and 116% since the start of the same time last year.

- 2025 contracts bucked the trend closing the month flat at $105/MWh (which is still very high).

How did supply and demand affect price?

- The volume-weighted average spot price (VWAP) surged to $335/MWh over May and prices rarely dipped below $100/MWh (only 263 intervals out of over ~8900).

- Fuel costs are the primary driver of these record-high prices with gas prices doubling over May and the thermal coal export price doubling since the Russian invasion of Ukraine.

- Black coal supplied 62% of NSW’s electricity over May with gas supplying a further 6%.

- NSW gas wholesaler Weston Energy collapsed in the final week of May citing untenable working capital requirements due to the speed and scale of the gas price spike.

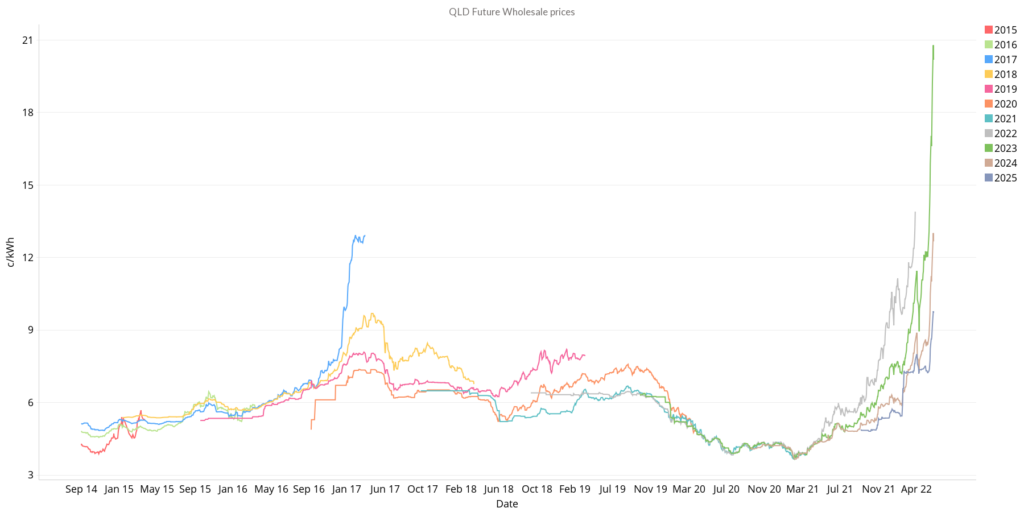

Queensland

- Queensland’s 2023 contract have reached an eye-watering $201/MWh after peaking at $208/MWh. Prior to this year, futures contracts had been sub-$100/MWh for the past 5 years and sub-$60/MWh since January 2020.

- 2024 contracts also smashed through $100/MWh, trading at $126//MWh up 50% for the month.

- 2025 contracts are trading at $97/MWh.

How did supply and demand affect price?

- Queensland has the highest VWAP spot price in the NEM at $370/MWh – it was $53/MWh at the same time last year. Prices spiked above $10,000/MWh on 16 occasions and there were just 30 intervals of negative prices during the month.

- Queensland produced just 16% of its electricity from renewables in May, leaving it highly exposed to the fuel price crisis. Black coal produces 71% and gas 12% which was the highest thermal proportion in the NEM.

- Sunshine Coast energy provider LPE announced it would exit retailing due to “extreme and consistent price volatility never previously seen” and may be the first of many smaller retailers to fold under the pressure.

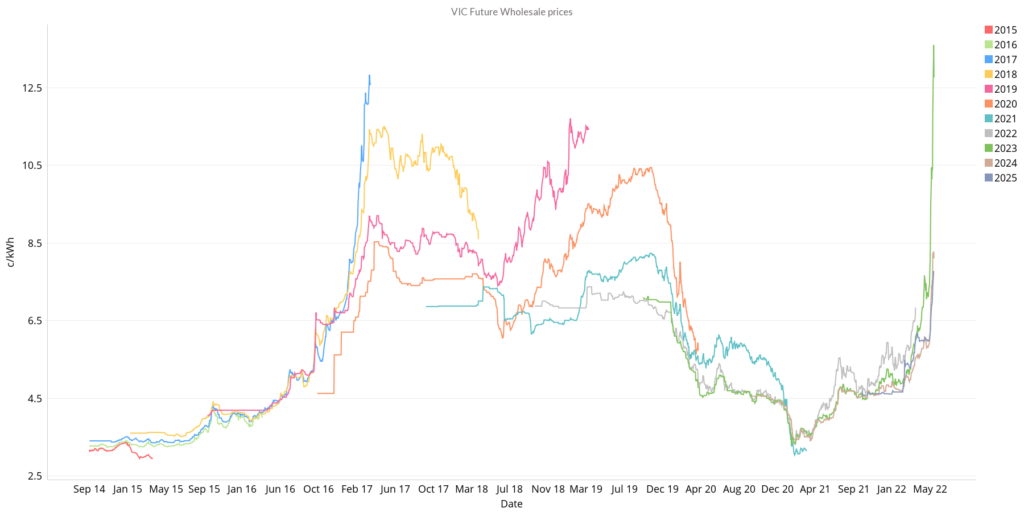

Victoria

- 2023 futures contracts spiked 72% from $74/MWh to $128/MWh over May and reached a high of $134/MWh

- Victorian prices have been never been higher. The previous high was in January 2019 when futures contracts briefly reached $117/MWh.

- 2024 and 2025 contracts are trading at $82/MWh and $78/MWh respectively which are looking like bargains in the current climate despite both being up over 70% since the start of the year.

How did supply and demand affect price?

- The volume-weighted average spot price (VWAP) continued to climb, rising to $245/MWh up from $150/MWh last month.

- Brown coal and renewables were the primary sources of Victorian electricity, producing 61 and 32% respectively over May with gas and imports rounding out the total.

- AEMO imposed a price cap on gas as a polar blast sent forecast wholesale gas prices to an ‘apocalyptic’ $85/GJ – wholesale gas prices are generally around $10/GJ

- AGL’s Loy Yang A suffered an outage and announced that the affected 530MW unit will remain offline until at least August adding to supply woes.

- The Victorian regulator has made the first move in passing on higher wholesale prices to customers by raising the standing offer by 5% from July 1 with other states expected to follow.

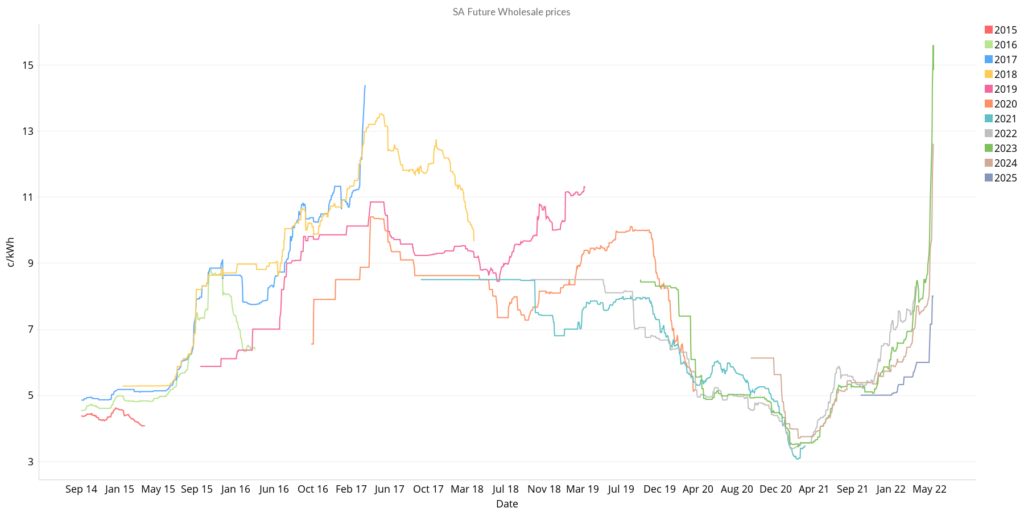

South Australia

- South Australian futures have broken through the $100/MWh mark for the first time since January 2019 with 2023 contracts soaring 75% to $149/MWh after starting the month at $85/MWh.

- 2024 contracts spiked 67% to $126/MWh with most of the rise coming later in the month in response to extreme gas prices.

- 2025 is trading at $80/MWh. All contract periods were trading below $40/MWh at the same time last year.

How did supply and demand affect price?

- The May 2022 energy market showed that renewables supplied 58% of the state’s May electricity needs with the majority coming from wind (42%).

- The state relied on gas for 31% of its electricity and is suffering due to record gas prices which are now being capped by AEMO in the eastern states).

- The VWAP spot price was $346/MWh with extreme volatility spanning -$1000/MWh to $15,000/MWh.

- Low wind conditions on May 12 briefly raised the prospect of a load shedding event but the state managed to scrape through.

- The month ended with a rare piece of good news as Australia achieved a new wind generation record in the early hours of May 31. SA contributed 1,700MW to the 6,639 MW record and enjoyed negative prices during the high wind event.

Electricity markets are in turmoil as the global fuel crisis drives our domestic electricity prices into uncharted territory. The May 2022 electricity market demonstrated that price increases are beginning to be passed on to retail customers while businesses exposed to spot prices are beginning to fold. Forward contracts can provide price certainty and protection from energy shocks and our energy experts can help you formulate a plan to navigate the difficult road ahead. Reach out now.

Disclaimer: The information in this communication is for general information purposes only. It is not intended as financial or investment advice and should not be interpreted or relied upon as such.