The 700-Megawatt Callide B Queensland coal-fired generator will shut down 10 years ahead of schedule in 2028, prompting fears that night time spot prices will spike.

Queensland is very heavily reliant on black coal-fired energy generation, but also has one of the highest new large-scale solar penetration rates in Australia.

The state government has set an ambitious target for 50 per cent renewables generation by 2030, which means that Queensland coal will have to be phased out.

Queensland coal generation currently outstrips renewables

To show just how ambitious that target is, Queensland currently consumes 5,181 MW of fossil fuel-generated power and just over 1,000 MW of renewables generated electricity.

The interactive chart below shows a live representation of demand and supply across Australia.

The impact of daytime solar

There is no doubt that solar generation is cleaner than coal and is also cheaper than any possible new investment in fossil plant generation.

But the fact that it is cheaper to produce does not mean that prices automatically go down.

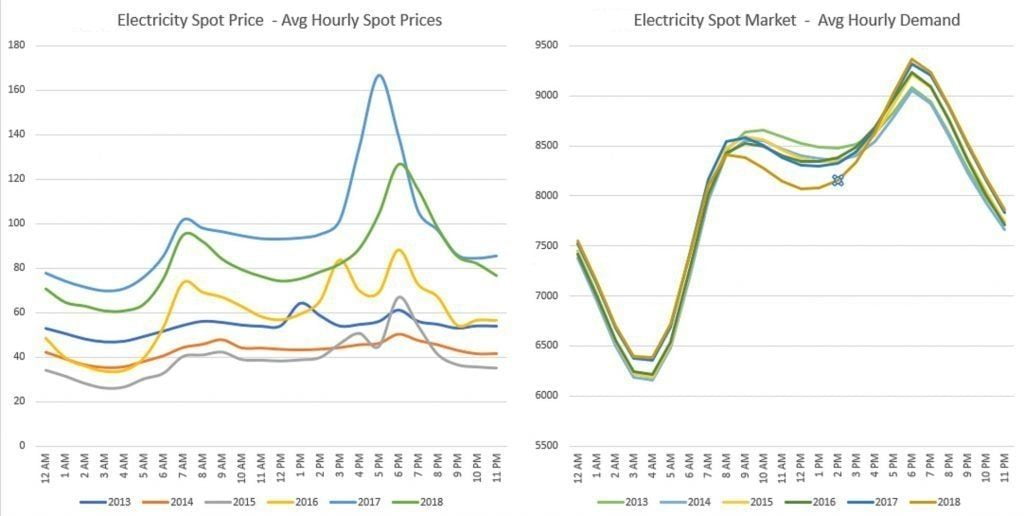

In fact, the truth is very much the opposite. During the day, cheap solar floods into the grid and has now got to a point where all states have experienced negative pricing, all at the same time.

So far so good? No.

As soon as the sun goes down and all that energy which was flooding into the grids bottoms out, prices shoot up astronomically, creating what is known as the Duck Curve.

What is the Duck Curve and why does it happen?

The issue is two-fold. First of all, coal generators can only run profitably if they are fired up constantly.

Because they suffer from inertia, they cannot just flick the switch and produce electricity.

This is why Queensland coal generators remain ‘switched on’ around the clock.

This process takes time. Open Cycle gas-fired power stations can be quickly fired up to meet demand, but gas is very costly.

As soon as solar generation drops out, demand spikes considerably as soon as people get home from work and go about their usual routine: Turn on the airconditioning unit, put the kettle on, iron clothes for the next day and switch on the television.

Simple economics means that demand shoots up while supply is at its tightest, with coal-generators keen to claw back the day’s earlier losses.

Battery storage

The most obvious solution is facilities to store abundant solar storage for release into the grid as soon as it is needed.

South Australia was the first state to demonstrate that wind and solar coupled with a battery is a feasible solution.

Pumped Hydro

While they can dispatch power immediately, large scale battery storage facilities can only keep going for a short time and must be supported by other generation.

Enter hydro. Pumped hydro involves unleashing the tremendous potential of water down through tunnels to drive turbines and create electricity, with a speed that is very close to being ‘on-demand’.

Government-owned Snowy Hydro in New South Wales is Australia’s best-known example of the technology.

Pumped hydro is regarded as battery storage because it is, in fact, potential energy. What also needs to be taken into account is that the water must be pumped back uphill when electricity is cheap.

Before the Duck Curve phenomenon manifested itself, this used to happen at night.

However, new modelling suggests that it is more cost-effective to do it during the day during times when low or negative pricing is experienced.

Another important factor to bear in mind is that catchment lakes must also be at good levels to use pumped hydro – meaning that periods of drought can also affect the reliability of supply.

This can cause the opposite effect of balancing prices through over-reliance on hydro.

Demand Response

Another factor that can help mitigate spot price volatility is Demand Response, which relies on scheme participants to scale back electricity consumption during times when supply is tight.

This model rewards those who send surplus energy back to the grid at times of peak demand.

An example of this is when pool pumps temporarily stops working when there’s a power crisis.

Demand Response schemes set up by the Australian Energy Market Operator involves higher-end energy consumers cutting back on energy use in return for payment or credits.

This curtailed consumption is known as ‘negawatts’.

The Australian Energy Market Commission is proposing legislative changes whereby businesses can sell their curtailed energy demand – negawatts – into the wholesale power market in a bid to drive down prices.

If the rule change is approved, it is expected to be introduced in July 2022.

There are three main types of wholesale demand response:

1. Customers can provide direct load control of their appliances to a third party (like a network business or retailer);

2. Consumers can choose a time to use retail contract or a contract with direct exposure to wholesale prices and cut their electricity use at high price times

3. Third parties can be allowed to bid demand reductions into the wholesale market as a substitute for a generation under a wholesale demand response mechanism.

The first two types of demand response are already happening in the NEM. The third type would be established by the draft rule.

Interconnectors

Another important contributor to stability on the National Energy Market is interconnectivity.

Interconnectors are essentially huge power transmission cables that link one state to another, to allow electricity to be traded when needed.

This is another instance where Queensland coal-fired generators come into play as they export electricity South to New South Wales and in turn, Victoria.

There are a number of interconnectors around Australia, but the announcement of two new ones: One between New South Wales and South Australia and one between Tasmania and Victoria will help balance volatility.

South Australia is very reliant on renewable energy and often suffers from shortfalls, but also produces a surplus when the wind is blowing and the sun is shining.

Tasmania, with its wealth of hydro assets, also continues to push to become ‘The Battery of the Nation’.

Tasmania often exports a substantial amount of energy to Victoria. However, in instances when the Basslink interconnector fails, as it did in September, spot prices in Victoria shot up to astronomical levels.

TasNetworks said a new 1500 megawatt Marinus Link connecting Tasmania to the mainland is technically feasible.

A 1500 megawatt Marinus Link represents an increase in capacity of 300 megawatts from the previous modelled capacity of 1200 megawatts.

The new interconnector – which will not be completed before 2025 – will allow a failsafe redundancy to compensate for such events and help keep the NEM stable.

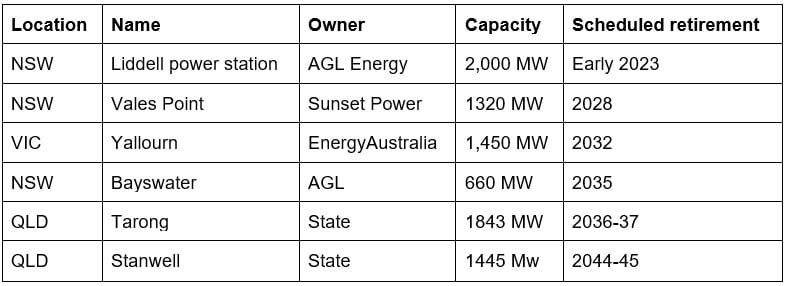

Coal power station retirement schedule

About Leading Edge Energy

Leading Edge Energy is a commercial energy broker and consultancy firm in Australia. We provide holistic energy cost-reduction services that include rates minimization, energy efficiency upgrades. solar generation and battery storage, and more, to make electricity or gas use and costs more manageable.

To start you off, we’ll go through a complimentary assessment of your usage and latest invoices, at no cost to you. Call our Energy Experts today on 1300 852 770 or drop us an email at hello@leadingedgeenergy.com.au.