Futures contract prices performed an abrupt u-turn at the start of August, dashing hopes from the previous month that the energy price crisis might be easing. There was actually plenty of good news, with spot prices falling rapidly as thermal generators returned to service and renewable output picked up coming into spring. All states saw their volume-weighted average spot prices (VWAP) fall by over 50%. Futures markets, however, were not impressed with prices soaring, particularly for 2023 contracts. It seems fuel price concerns are still dominating the outlook, with the northern hemisphere winter expected to drive demand for coal and gas exports through the roof. Read more to learn about what happened in the August 2022 energy market.

Reach out to our energy experts to lock in a strategy for the summer now.

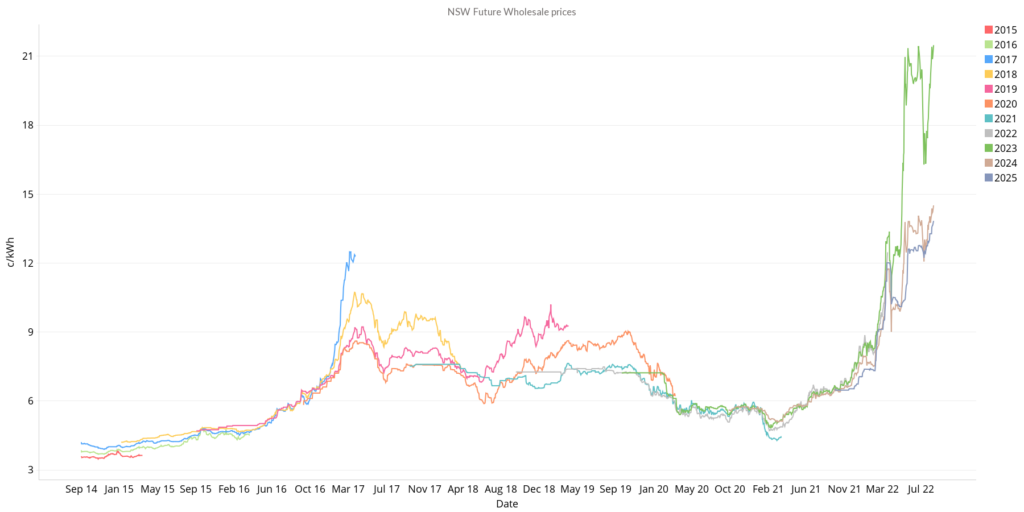

New South Wales

- 2023 futures spiked 31% to $214/MWh over August, giving up all the improvements of the previous month. The increase is an unimaginable $50/MWh.

- 2024 and 2025 contracts experienced smaller increases, finishing the month at $144 and $136/MWh respectively.

How did supply and demand affect price?

- Spot prices softened considerably over August with the VWAP falling to $157/MWh from $394/MWh last month.

- Prices ranged from -$55 to $503/MWh suggesting a significant easing of supply pressures.

- Renewables contributed 23.4% of the state’s energy and reliance on gas was very low – just 1.7%.

- The third unit of Bayswater has been restored returning 660 MW of much-needed capacity.

- Many of the factors driving high prices have eased considerably, however, the Northern Hemisphere is now moving into winter and global demand for coal and gas exports will soar due to the continuing crisis in Ukraine. This expectation may be the driver of the disconnect we are currently seeing between the spot and futures markets.

Victoria

- 2023 contracts spiked 37% over August to $137/MWh. Still slightly lower than the peak of $150/MWh in July.

- 2024 contracts rose 21% to $92/MWh.

- 2025 contracts have been less volatile but steadily rising. They have now reached $81/MWh which is a new high.

How did supply and demand affect price?

- The spot market softened considerably. The VWAP fell to a much healthier $133/MWh from $373/MWh last month.

- The spot price was slightly more volatile than NSW spanning -$122/MWh to $1,462/MWh.

- The outage at unit 2 of Loy Yang A has been extended. AGL had estimated it would be back online on August 1 after an electrical fault but has now said it will be late September at the earliest.

- Renewables, particularly wind, have stepped in to fill the gap with a massive 42% of the state’s power coming from renewables. On August 19 wind alone supplied 69% of Victoria’s demand during an early morning interval.

- Further wind capacity is coming online with the 530MW Stockyard Hill ramping up into spring.

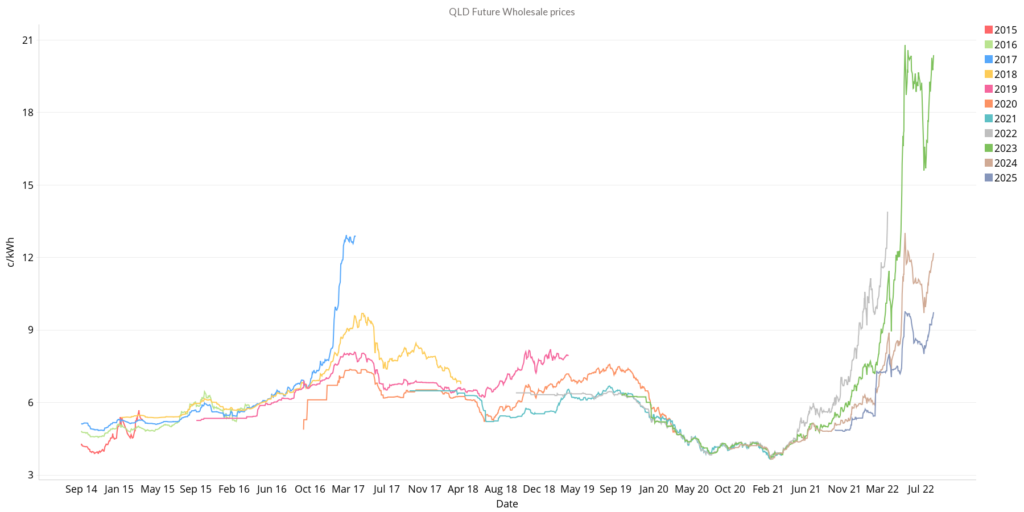

Queensland

- 2023 contracts are back above $200/MWh after falling to $155/MWh at the end of July.

- 2024 and 2025 both saw significant increases rising to $118 and $92/MWh respectively.

How did supply and demand affect price?

- As with NSW and Victoria, spot prices eased significantly over August with the VWAP falling to $147/MWh from a shocking $445/MWh in July.

- Prices were much less volatile, with only one spike to the $15,500 price cap

- Renewables supplied 22% of the state’s energy for the month with the majority coming from solar

- Rooftop solar pushed Queensland’s minimum operational demand to a record low with AEMO estimating that 44% or 2,777MW of underlying demand was met by behind-the-meter systems during the sunny, mild winter Sunday

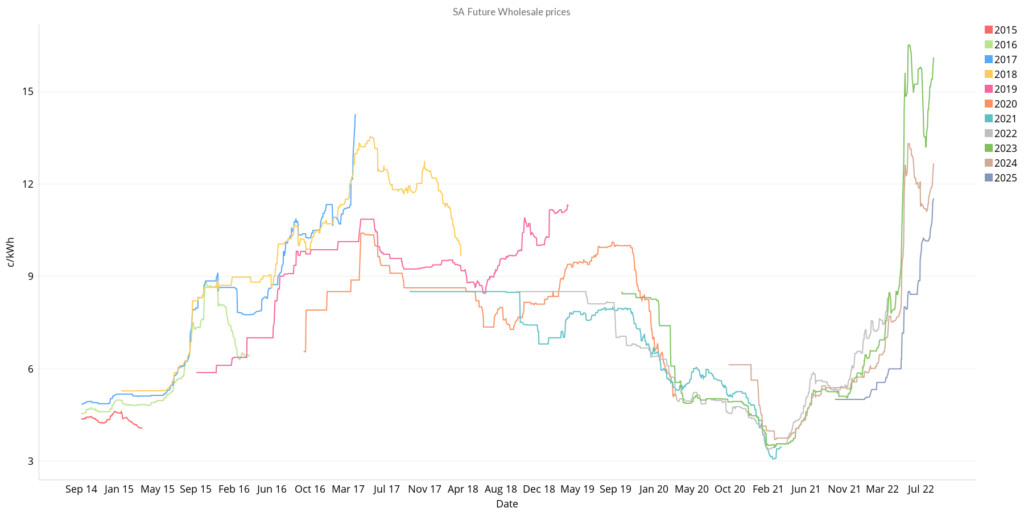

South Australia

- 2023 contracts spiked 16% to $154/MWh, still below the high of $165/MWh seen in June

- 2024 contracts rose slightly to close the month at $119/MWh

- 2025 contracts are at an all-time high having more than doubled from $50/MWh at the beginning of the year to $107/MWh at the close of August

How did supply and demand affect price?

- Spot prices eased with the VWAP falling from $410/MWh in July to $190/MWh which is now the highest in the NEM

- Volatility remained a key characteristic of the SA energy market in August, with swings from -$1000/MWh to $15,500/MWh as renewables and gas vie for price-setter status

- Renewables have been winning the battle more often as wind generation picks up. Renewables supplied 70% of the state’s electricity in August with a further 8.3 coming from imports and gas providing the remainder

August saw electricity futures prices drop as APLNG redirected gas supplies into the domestic market. The gas producer was also running at 50 percent capacity during this time, but the redirected supplies had enough of an impact to lead to softer electricity futures prices.

Futures markets are still nervous and jittery with the looming northern hemisphere winter likely driving anxiety over coal and gas prices. We are continuing to help our clients manage price volatility through a range of strategies.

In particular we are recommending that businesses consider signing up with a retailer that offer blend and extend contract options.

Blend and extend allows businesses to extend their contract when market prices drop, leading to a lower average price for the contract duration.

We hope our report on the August 2022 energy market has proven informative and insightful. Reach out to our energy experts to understand your options in these difficult conditions.

Disclaimer: The information in this communication is for general information purposes only. It is not intended as financial or investment advice and should not be interpreted or relied upon as such.