The energy markets offered mixed news last month as futures contracts continued the sharp upward trend established in August.

In better news, spot prices continued to soften slightly and remained stable after July’s crisis.

Spot prices in all but one of the National Energy Market states dropped as renewable energy picked up coming into spring and the return of thermal generators from the previous month began to be felt.

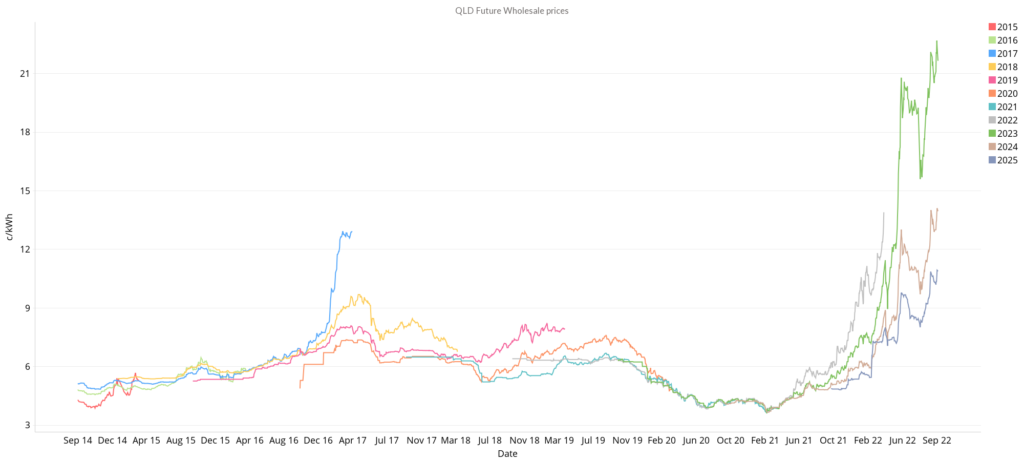

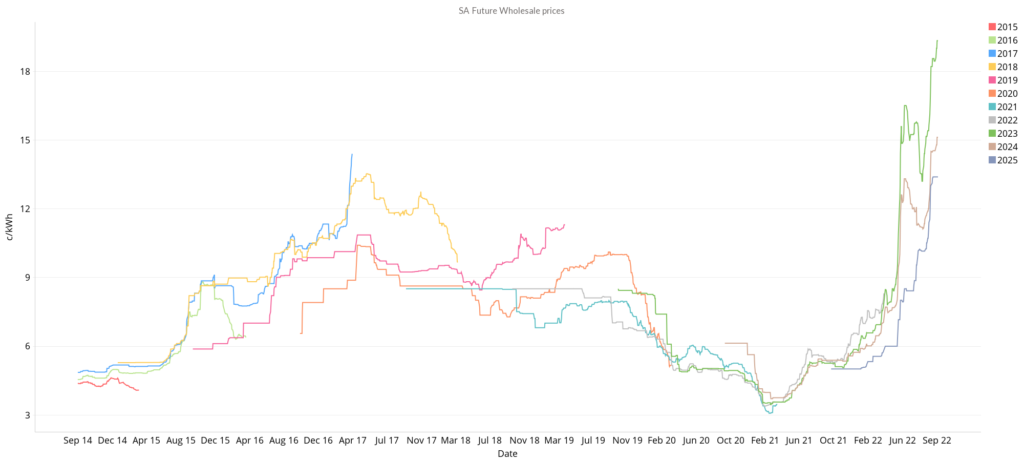

Futures markets continued to soar, particularly for 2023, and sharp upticks in most NEM states were also recorded for 2024 and 2025.

Fuel price concerns continue to dominate the outlook, with the northern hemisphere winter expected to drive demand for coal and gas exports through the roof as Europe looks for alternatives to Russian gas.

We understand that this is a particularly worrying time for businesses.

If you need help comparing electricity and gas plans, reach out to our energy experts now to lock in a strategy for the summer. Read more to learn about what happened in the energy market in September 2022.

New South Wales

- 2023 futures spiked to $242 in the second week of September up from $214 at the start of the month.

- There was a significant drop down to $212 in the third week of September, but futures finished the month on $232, an 11% increase over the previous month.

- 2024 contracts experienced increases, finishing the month at $167 climbing from $143 at the start of August.

- 2025 contracts experienced a small increase of $12 per MWH from $137 at the start of the month, closing at $149.

How did supply and demand affect price?

- Spot prices dropped very slightly in September with the volume-weighted average price (VWAP) falling to $154/MWh from $157/MWh last month.

- Electricity prices ranged from -$80 to highs of $1025/MWh suggesting some volatility.

- Renewables contributed 28.9% of the state’s energy, and reliance on gas was very low – just 2%.

- Many factors driving high prices have eased considerably, however, the Northern Hemisphere is now moving into winter, and global demand for coal and gas exports will soar due to the continuing crisis in Ukraine. This expectation may be the driver of the current disconnect between the spot and futures markets.

Victoria

- 2023 started the month at $137 per MWh. Following the same trend as NSW, Victorian contracts jumped $20 to $157 in the second week of September.

- Prices softened to $131 but spiked by 15% to $157 per MWH at the end of September, which is higher than the previous spike in July.

- 2024 contracts started the month at $94 and ended the month at $111.

- 2025 contracts started the month at $81 rising to $90 to set another new high.

How did supply and demand affect price?

- The spot market continued to soften with the VWAP falling to $111 from $133 last month.

- The spot price was less volatile in Victoria than in NSW, spanning between -$133 and $630.

- The outage at unit 2 of Loy Yang A has been extended. AGL estimated it would be back online on August 1, but parts are still en route from Switzerland. The retirement of this power plant has been brought forward by 10 years to 2035.

- Renewables, particularly wind, have stepped in to fill the gap supplying the state with 38.6 % of its power. On 17 September, wind accounted for 46.1% of generated energy.

- Further battery capacity is in the pipeline as the Victoria government announced funding for a 125MW/250MWh battery at Koorangie and a 100MW/200MWh battery at Tareng.

Queensland

- 2023 started the month at $199 per MWh. Similar to NSW and VIC, prices dipped before climbing steadily to close September at $224 per MWh.

- 2024 contracts started the month at $119 and ended the month at $141, up 18%.

- 2025 contracts started the month at $95 rising to $109 to close off September.

How did supply and demand affect price?

- Spot prices increased slightly with the VWAP rising to $157 from $147 the previous month.

- Prices were volatile, ranging between -$996 and hitting the $15,500 price cap on one occasion.

- Renewables supplied 24.4% of the state’s energy for the month with the majority coming from solar (18.6%).

- Rooftop solar pushed Queensland’s minimum operational demand to another record low of 3469 MW with AEMO estimating that behind-the-meter systems supplied 46% or 1,595 MW on 12 September at 1 pm.

- Queensland’s government has announced plans for 22GW of new wind and solar, 11.5GW of rooftop solar, and what it says will be the biggest pumped hydro project in the world.

South Australia

- Futures prices in SA followed a different trend from the rest of the NEM. Prices climbed sharply at the start of the month, reaching a plateau and spiking to close out September.

- 2023 contracts started the month at $154, climbing and settling around the $185 mark and climbing further to $194 to close off September. This was a 25% increase.

- 2024 contracts started the month at $120 and ended the month at $151.

- 2025 contracts started the month at $110 rising to $134 to close off September.

How did supply and demand affect price?

- Energy spot prices in September eased with the VWAP falling from $190/MWh to a more reasonable $148

- Volatility remained in the SA market with four instances of pricing at -$1,000 and 4 instances of market capping at $15,500/Mwh.

- Renewables are the major generation force in SA with 74% of the state’s energy mix. Gas plugged most of the gap with 25.2% and battery storage accounted for the remainder.

The energy market trends in September 2022 largely followed what was set in the previous month, with major outages still affecting AGL’s Loy Yang A in Victoria and Callide C in Queensland.

At least renewables are picking up as the weather improves into spring. Two major announcements were also made this month, with AGL bringing the closure of Loy Yang A forward by 10 years to 2035.

Australia’s most coal-dependent state, Queensland, has announced plans for 22GW of new wind and solar, 11.5GW of rooftop solar, and what it says will be the biggest pumped hydro project in the world.

Futures markets are still nervous and jittery with the looming northern hemisphere winter likely driving anxiety over coal and gas prices.

We are continuing to help our clients manage price volatility through a range of strategies.

We hope our September 2022 energy market review has proven informative and insightful. Reach out to our energy experts to understand your options in these difficult conditions.

Disclaimer: The information in this communication is for general information purposes only. It is not intended as financial or investment advice and should not be interpreted or relied upon as such.